By Mike Netzer · 6/2/2021

Our latest podcast touches on the changes that have happened in the Phoenix area over the last five years.

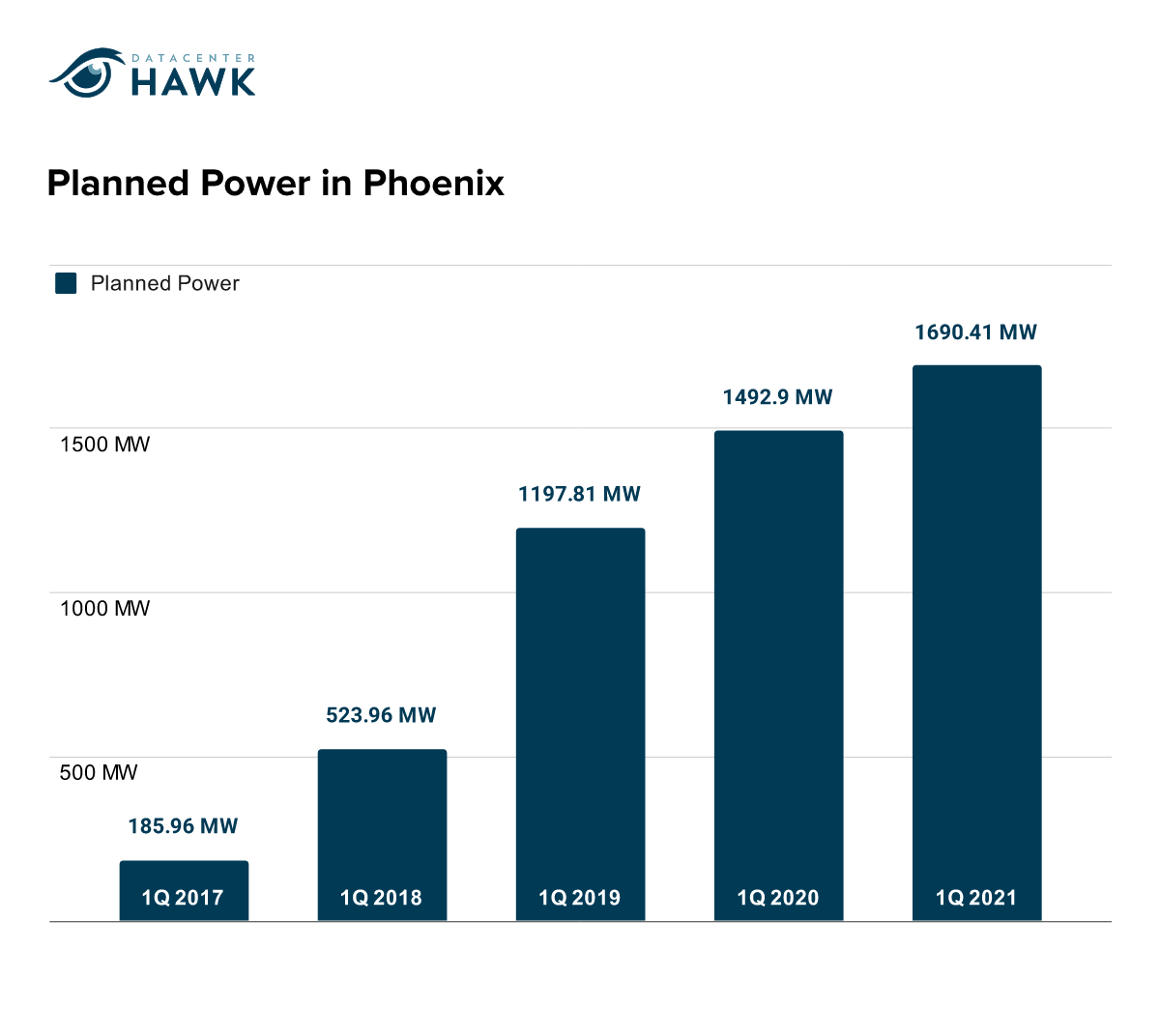

By measuring the planned power for data centers, the growth metrics become clear. Planned power went from 186 megawatts in 2017, all the way to 1,690 megawatts in 2021. This is to enable the rapid hosting of cloud service providers as soon as they’re ready to make their move into local facilities. Some data centers intentionally overestimate their power requirements, sometimes to the point of speculation, just to be ready for a theoretical client boom in the upcoming months.

Phoenix is one of the few municipalities that can offer providers of data center services the entire package necessary for immediate growth: Copious amounts of space, sufficient power, water, friendly taxation, and modern purpose-built facilities. When companies look at the operations and opportunity costs of Arizona when compared to the likes of California, Phoenix becomes quite attractive.

Corporate Attitudes Driving Data Center Services

One of the things that is driving the data center services market in mid-2021 is the trend of moving cloud services as close to the demarcation point as possible in enterprise networks. This means cloud service providers are scrambling to find local presences in major metropolitan data centers, wherever their clients have a significant facility.

The reasons are many, ranging from low latency demands from financial services companies to continuous monitoring needs for high uptime applications. Whatever the clients’ reasoning, they need to make use of techniques that feed into high-speed hybrid clouds. Their needs have to be handled on many different layers of the OSI model, and fully automated to be useful to the DevOps engineers setting up the application servers. This creates a division of labor between the data center services company, the cloud service provider, and the corporate client. Millisecond-critical criteria could be set on a variety of different services: UPS functionality, rack monitoring, network hardware, environmental controls. And that means local points of presence for the cloud provider in every city where their clients operate.

Additionally, Phoenix has a ton of enterprise market growth. Companies already based in the area are expanding now that they have a better grasp of what the post-pandemic landscape will look like. They’re also adding additional capacity as telecommuting becomes a permanent part of their corporate culture. In the near future, the enterprise sector will go back to pre-Covid levels of expansion, if the experts are correct in their predictions.

Speaking of looking into the crystal ball…

Predictions for Phoenix’s Future

As much as the data center services industry in the Phoenix area likes to think that land and building locations are plentiful, that isn’t likely to be the case in five years. In Mesa and Goodyear, there are currently large tracts of land and plenty of power. But there is increased residential demand in Mesa, which will rapidly swallow up any land that can be rezoned for residential use and will grant planning permission. Goodyear’s popularity within the e-commerce market means that they’re being targeted by large distribution centers. The seemingly infinite space for growth today might be severely stymied in certain parts of the city by 2025.

We are quite bullish on the future of data center services and cloud service providers in Phoenix. Though there are enough different entities to keep pricing competitive, there’s also enough demand to allow all of the dedicated players to thrive. And from past commercial interactions, we can be almost certain that the assets and space of any data center company who falters will be rapidly acquired by one of the bigger players in the marketplace.

Building up the technical capacity that will ensure smooth upscaling for PaaS and SaaS clients is going to be critical over the next three to four years. That means pushing the automation of on-demand services right to the limit, and provisioning for more ad-hoc expansion than data centers have traditionally done in the past.

At datacenterHawk, we'll continue to track the Phoenix data center market growth. If you would like to see more of our analysis and trends of this market, click here to request access.