By David Liggitt · 10/21/2021

Over the past few weeks our team analyzed more than 10,000 real estate data points on data centers across the globe and released that analysis in Hawk Insight, datacenterHawk’s market research product. We’ve compiled a summary of our analysis from that release in this recap.

If you have data center related decisions coming up in the next 3-6 months, connect with our team to see how the datacenterHawk platform can help bring clarity to your understanding of data center markets and help you move forward with more confidence.

Several unique supply and demand dynamics arose across data center markets across the globe during 3Q 2021.

On the demand side, requirements from hyperscale users continue to grow. Demand from the enterprise sector returned as the number of 1-5 MW opportunities increased.

On the supply side, providers and hyperscale users continue to land bank across North America, Europe, and Asia Pacific. There continues to be an increase in emphasis on managing the supply chain, particularly with the power dynamics in Europe and Asia Pacific. Timing the delivery of facilities and capacity also continues to grow in importance.

North American Data Center Markets

Data center markets in North America saw healthy activity in 3Q 2021. While growth was more measured, demand was strong and signals to remain strong in 4Q 2021.

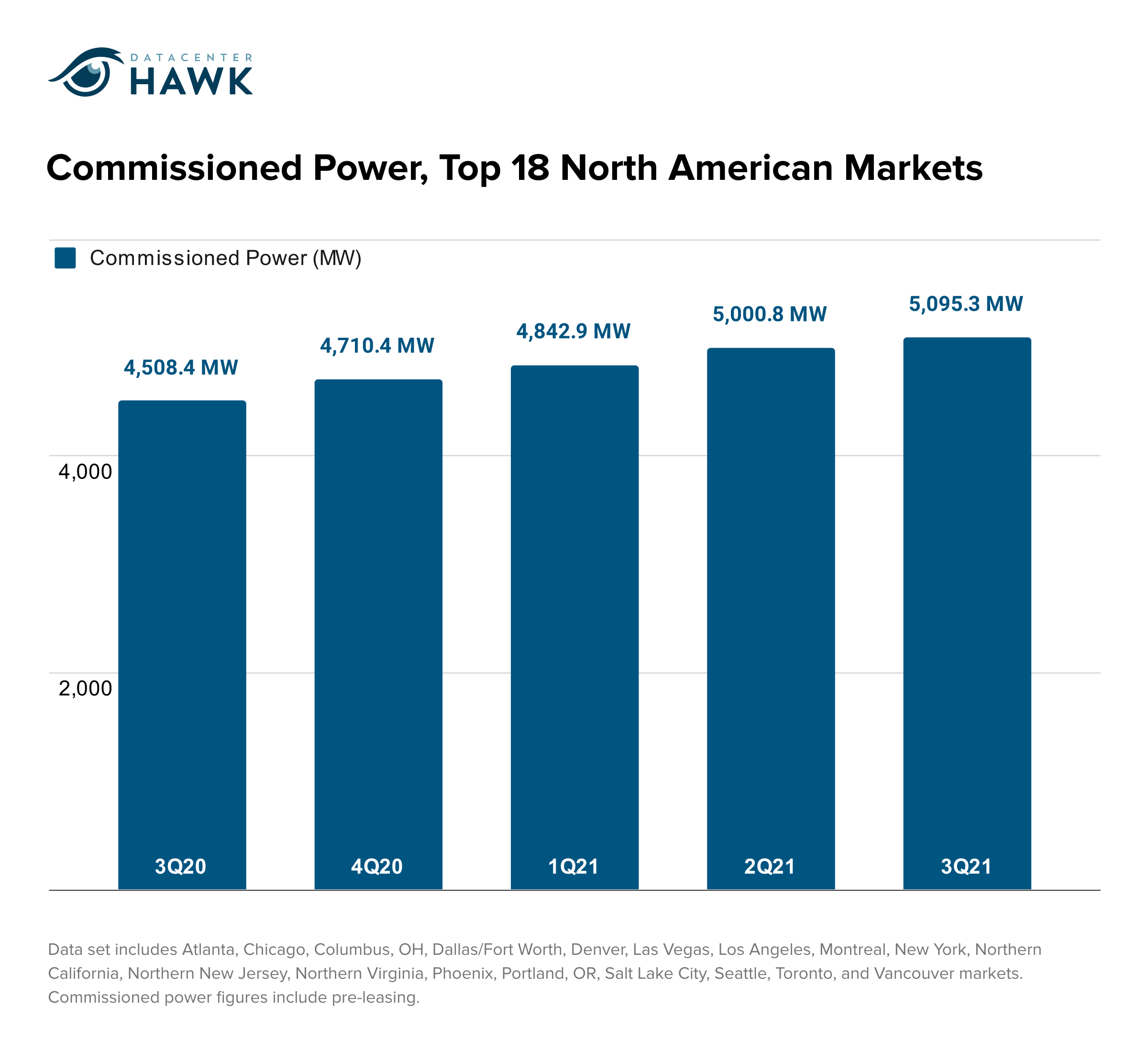

At datacenterHawk, commissioned power is the metric used to gauge the size of each data center market. The higher the number, the more power there is leased or available to be leased in the market.

Commissioned power in the top 18 North American markets grew by 95 MW in 3Q 2021, a CAGR of 7.8%.

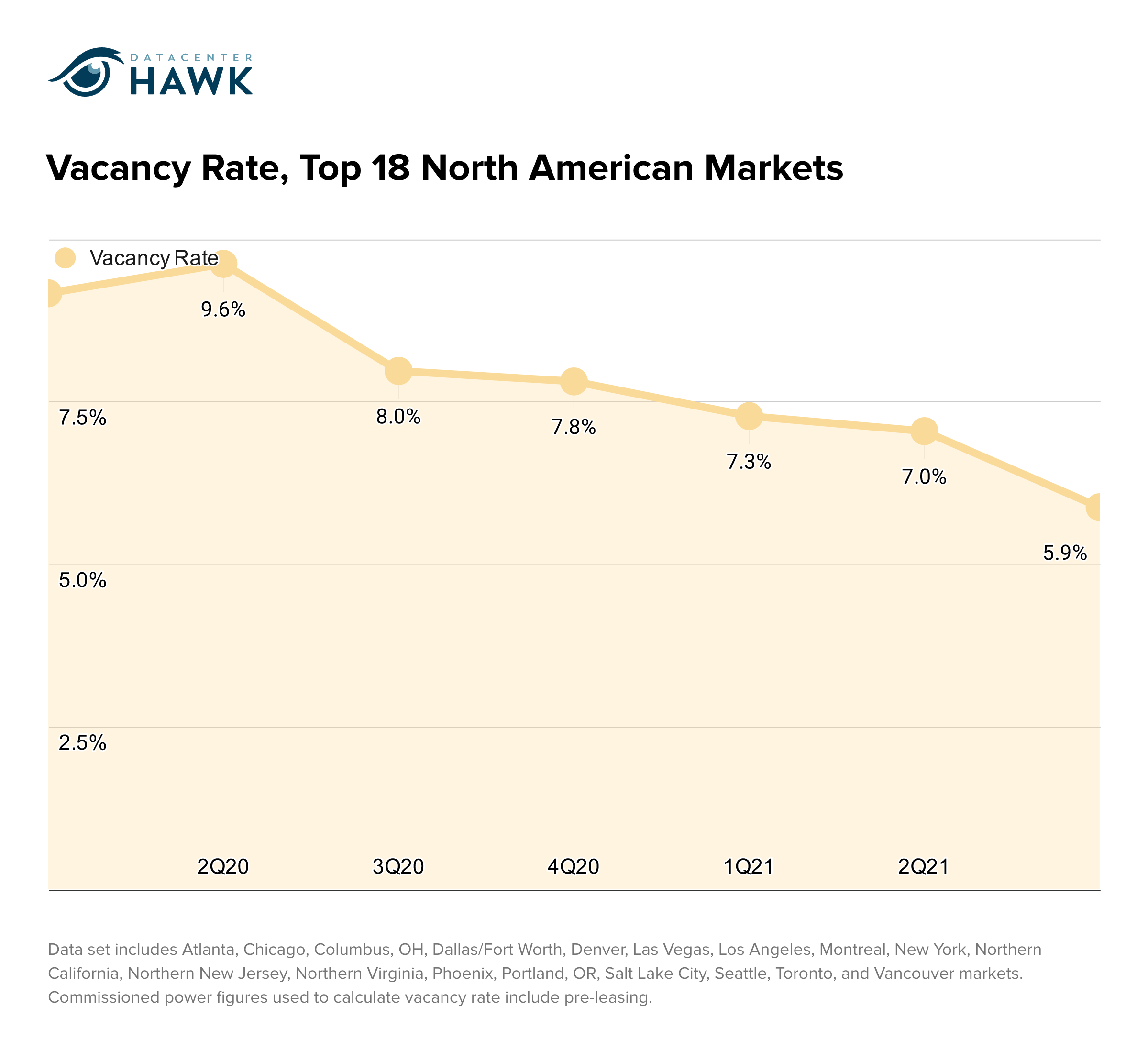

In 3Q 2021, vacancy rates declined 1.1%, down from 7.0% in 2Q 2021 to 5.9% in 3Q 2021.

Vacancy Rate, Top 18 North American Markets

Notable Trends & Markets

Hyperscale Demand Active

Demand from the largest data center users is growing. Several 10 MW+ requirements are actively evaluating the market and have time pressure to find a location soon.

Resurgence of Enterprise Demand

Enterprise requirements in the 1-5 MW range have increased in both volume and size. When the pandemic started in 2020, there was a notable decrease in enterprise user activity as they shifted long term strategies to support the short term needs of working from home. As the pandemic has started to lift and teams have had time to catch up, more of these requirements are returning to the market.

Northern Virginia

You can’t talk about data center markets without covering the largest data center market: Northern Virginia. Northern Virginia data center demand was moderate in 3Q 2021, but activity in this area continues to grow from both data center users and providers. Outside of leasing, land prices continue to rise as data center development parcels are acquired in both in Ashburn and other areas of Northern Virginia.

Looking Forward

While on an annual basis there hasn’t been as much demand this year as the first three quarters of 2020, we’re anticipating a stronger back half of 2021. There are several larger deals evaluating the market that we believe will land before the end of the year.

As demand from hyperscale users and enterprise users increase, if timelines start to slip on delivering new supply to the market, the balance in supply and demand could lead to lease rates pushing upward.

We’re also starting to see some of the trends that started in Europe make their way to North America, like the increasing emphasis on sustainability and a potential upcoming shift in public sentiment towards data centers.

If keeping tabs on the above dynamics is critical to your success, connect with our team to see how the datacenterHawk platform can help you maintain ongoing clarity of trends in data center real estate.

European Data Center Markets

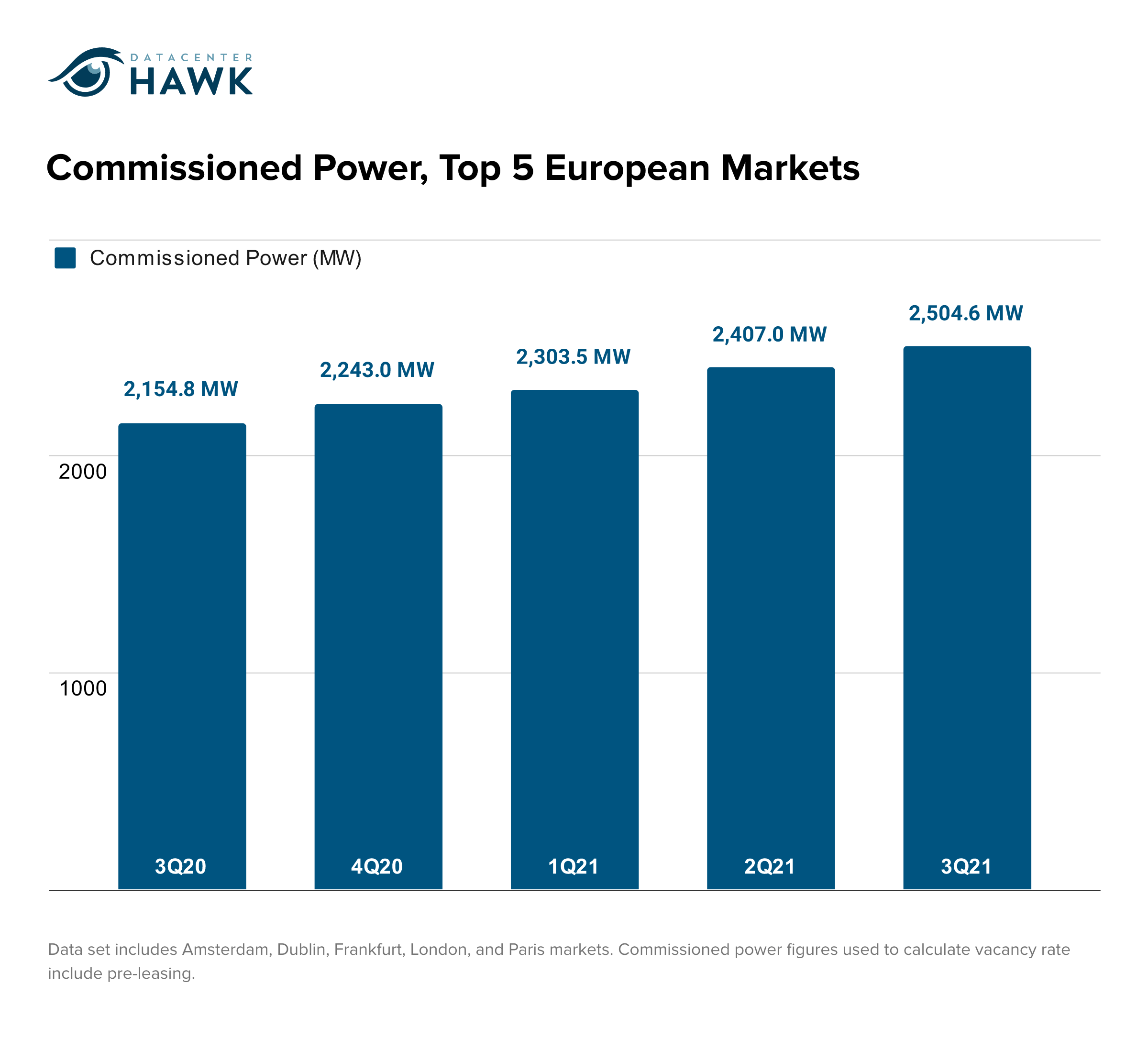

Commissioned power in the top five data center markets in Europe (Frankfurt, London, Amsterdam, Paris, and Dublin) grew by a collective 97 MW in 3Q 2021. This comes out to a compound annual growth rate of 17.2%.

Commissioned Power, Top 5 European Markets

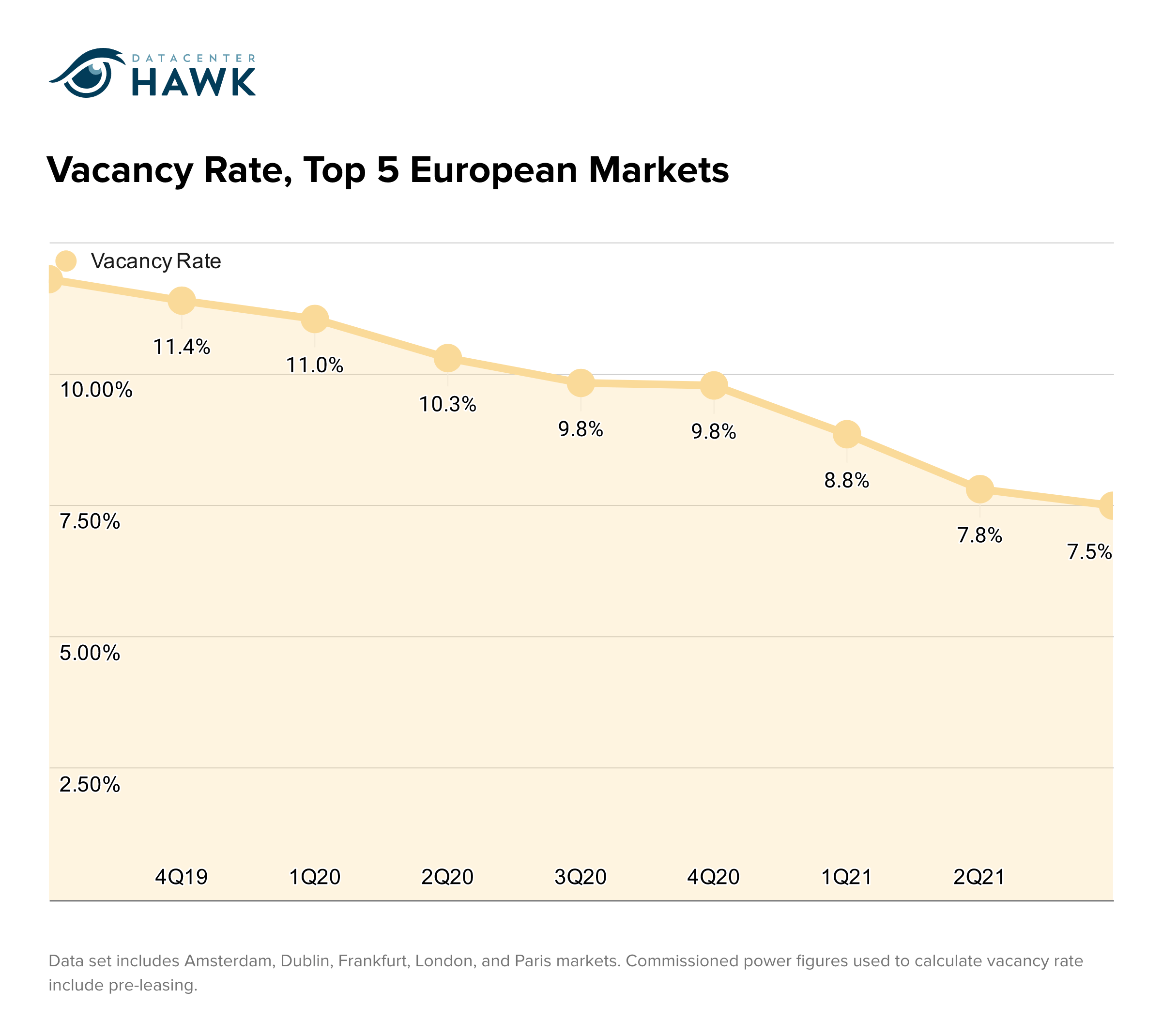

Vacancy rates across these same markets continue to drop as well.

Over the past two years, vacancy rates in Europe have decreased on average over half a percentage point per quarter, starting at 11.8% in 3Q 2019 and dropping to 7.5% in 3Q 2021.

Vacancy Rates, Top 5 European Markets

We continue to see increased demand from both small and large data center users. In 3Q 2021, pre-leasing increased as timeline needs continued to grow in importance to end users.

Notable Trends & Markets

Uncertainty Around Power Costs

While constraints on the supply of energy are not new to some markets in Europe, the recent increase in energy prices may lead to additional challenges both operationally and in the future supply chain. Data center providers and users without long term power agreements already in place may find themselves competing against those offering lower power pricing. On the supply side, peak power costs may keep suppliers up the pipeline from operating at peak capacity, compounding the stress already placed on the supply chain from the pandemic.

London

London is Europe’s largest data center market. In 3Q 2021, demand from large users drove both absorption and new project activity in the market. Overall vacancy has decreased over the past year to 9.5%, and multiple providers also received permits for new developments during the quarter. It continues to be difficult though to deliver capacity within the core London market. As these traditional development areas have become saturated, new development is pushing out to areas on the perimeter of the London market like Swindon, Milton, or Buckinghamshire.

Looking Forward

We think absorption will continue to be strong in the primary European markets. Growth has proven consistent over time and we think it will continue over the foreseeable future. We also anticipate continued growth in secondary markets, particularly as hyperscale users look to expand their footprint across the continent.

Asia Pacific Data Center Markets

When it comes to Asia Pacific, while some markets continue to work through government regulation around sustainable power and data privacy concerns, Sydney has seen increased activity.

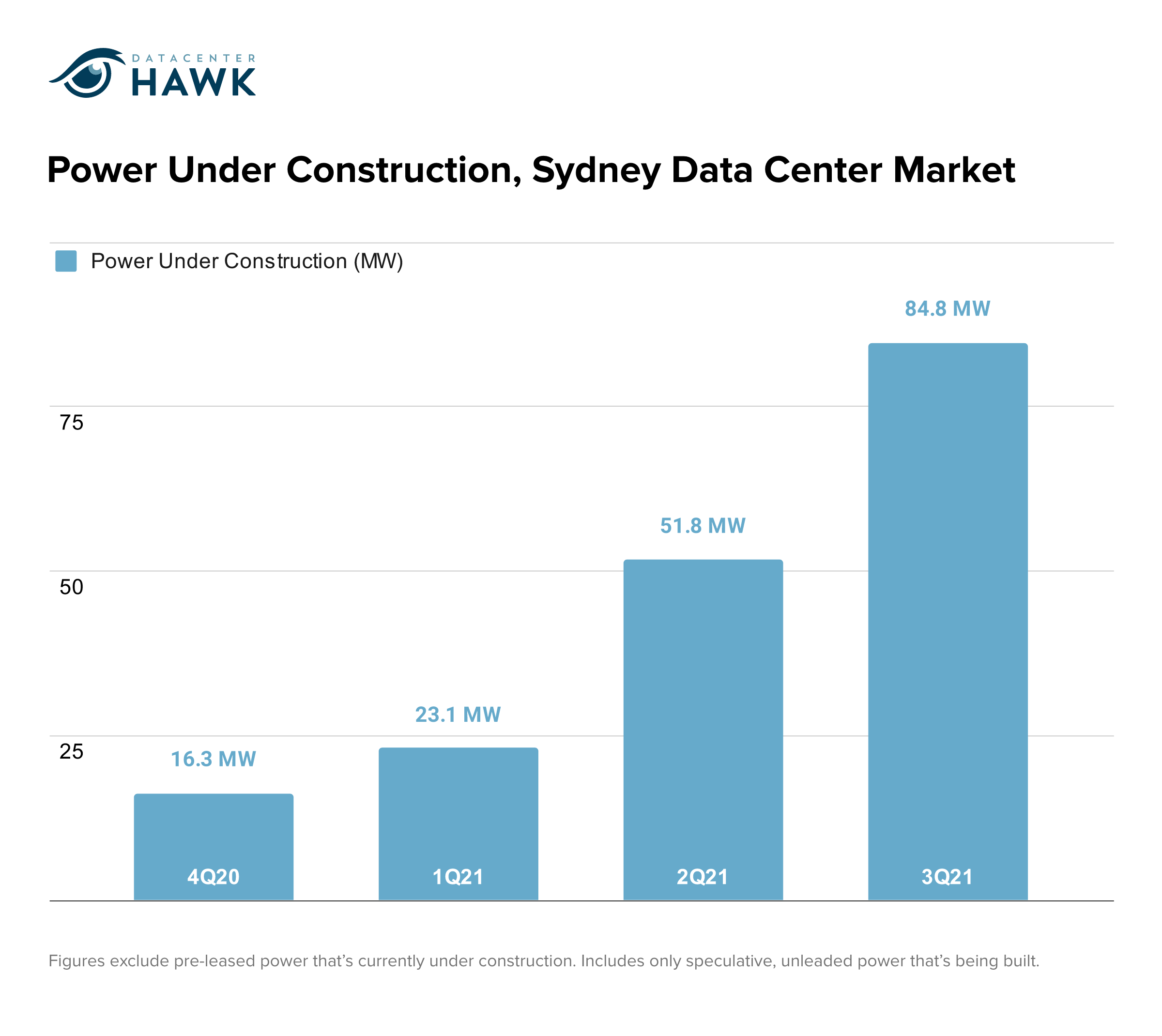

Speculative data center development has ticked up in Sydney over the past year. In 4Q 2020 there was 16.3 MW of unleased capacity under construction, which rose to 84.8 MW in 3Q 2021.

Power Under Construction, Sydney Data Center Market

One reason for the difference in Sydney compared to Singapore or Hong Kong has been the tone of government regulation. While Singapore is working on growing sustainably and Hong Kong is working through data privacy concerns, the government in Sydney has invested in making additional pathways for data center development.

Notable Trends & Markets

Sustainability & Singapore

Singapore continues to work to accommodate data center market development in an environmentally friendly way. The current vacancy rate is very low as they seek to shore up sustainable power. There’s still a decent amount of demand in the market, with several users seeking to expand their footprint. There’s also been an increase in pricing as a result of the above dynamics.

Data Privacy & Hong Kong

Hong Kong remains attractive as a global business market and carries a decent population size. While there’s certainly development happening, it will be interesting to watch future development there as the market works through issues of data privacy.

Looking Forward

Looking forward we anticipate a continued maturation in APAC data center markets. There continues to be demand from hyperscale data center users seeking to serve the population in the region. Sustainable power, data sovereignty, and government regulation are all trends to watch as development moves forward in this thriving region.

Wrap Up and Overall Outlook

Delivery project timelines will continue to be important as big demand circles major data center markets and campus developments grow more complex over time. Providers who have constructed shell space and can meet demand on a shorter timeline will have an advantage over those who have yet to break ground on new sites.

While this year predictably may not be as strong as 2020, we anticipate the back half of 2021 will be stronger than the first half and look forward to a potentially active 4Q 2021.

If you’ll be navigating data center markets during the back half of the year, it’s important to have a clear understanding of how these dynamics are playing out today. Connect with our team to see how the datacenterHawk platform can help you uncover new insights, validate your thinking, and accelerate your decision-making with confidence.