By Erica Hashert · 9/15/2021

London is experiencing an increase in planned power projects – rising from 409 MW in 3Q 2019 to 1,138 MW in 2Q 2021 - likely due to the following factors:

Great Britain’s exit from the EU

Although the event’s full impact on the regional data center market likely won’t be realized for a number of years, Brexit did little to dissuade elevated demand from providers who previously didn’t have a presence in the London market.

Wholescale, hyperscale requirements circling the market

The average data center requirement size in the London market has grown significantly over the last three years, and much of this growth is attributable to cloud service providers expanding their in-region services. Hyperscale demand has increased as well, with Microsoft, Google, and AWS all announcing increased footprints in the market recently.

Regional migration of supply to suburbs

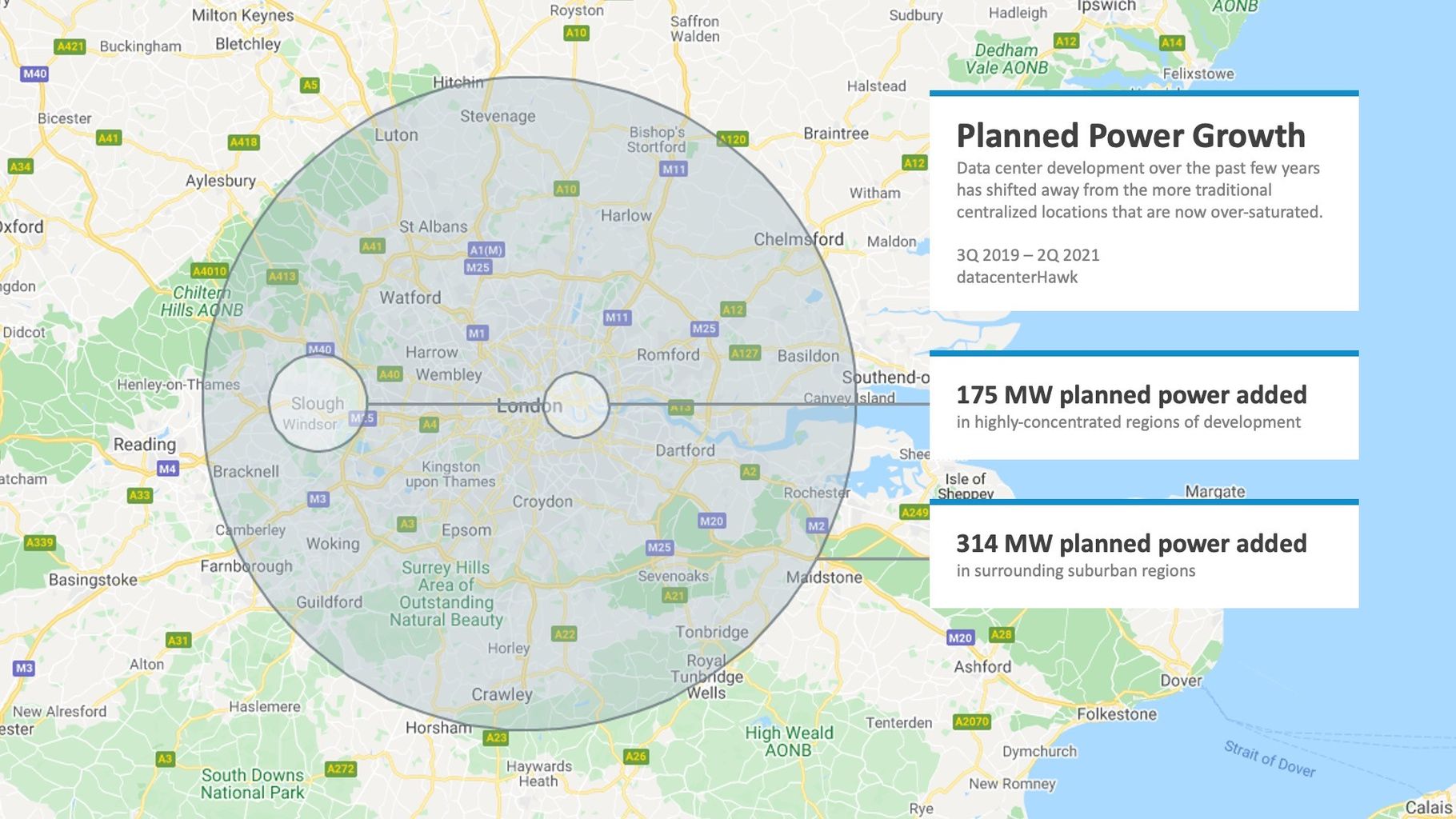

Development over the past few years has shifted away from the more traditional centralized locations that are now over-saturated. Operators are widening their focus with new projects planned in suburban regions like Bracknell, Chertsey, Chesham, Worcester, and others.

The below map illustrates this shift to the suburbs in the following visualizations of planned power between 3Q 2019 and 2Q 2021. As a qualifier, timelines on planned power can vary widely, but the metric stands as a measurement of power that’s expected to come to the market over the long term.

As development has accelerated in London data center hotspots, a number of challenges have arisen in the highly-concentrated regions. Slough and the Docklands, two such areas, are currently experiencing shortages in power as well as rising real estate costs. In combination with limited real estate availability, these challenges have driven operators that aren’t required to be located in those areas to nearby suburbs. This is reflected in hyperscale investment in the market as well, as both Google and AWS have the capacity for new data center developments in Broxbourne and Didcot, respectively.

From 3Q 2019 to 2Q 2021, eight new areas in the London market were earmarked for future development. While Slough and the Docklands continue to attract data center demand – gaining approximately 175 MW of planned capacity over the two years – the surrounding suburban regions now represent almost double that growth amount, with 314 MW added to culminate in 559 MW planned in 2Q 2021. We expect to see this trend endure, as the traditional development sites continue to experience higher costs and limitations on real estate and power resources.