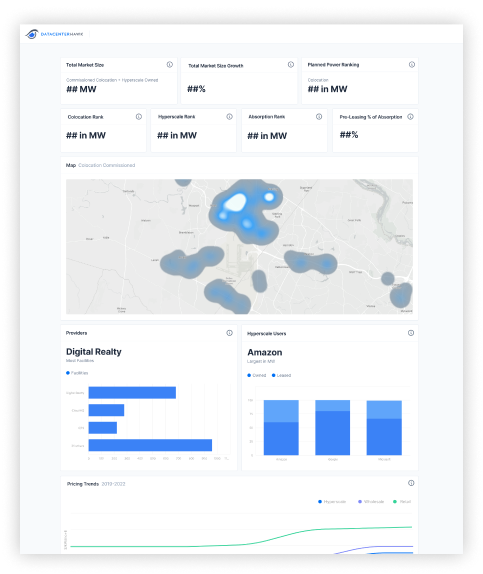

Data center real estate market in North America

Dallas/Fort Worth

Published less than a week ago

4th

In supply of data center real estate, measured by commissioned power

4th

In demand for data center real estate, measured by TTM absorption

6th

In hyperscale owned facilities, measured by operational power

Real estate supply pipeline

Rank amongst North America markets

Commissioned

Colocation power commissioned within the market, measured in MW, includes preleasing

Available

Colocation power commissioned and available within the market, measured in MW

Under Construction

Speculative colocation power under construction within the market, measured in MW

Planned

Speculative planned colocation power that hasn't yet broken ground, measured in MW

About Dallas/Fort Worth

The Dallas/Fort Worth (DFW) data center market has grown steadily over the past five years. Demand in the DFW market often originates from companies with a large presence in the area. However, many companies outside the area evaluating the DFW market find it appealing. Most companies go to Texas due to the state's central location, affordable real estate prices, and aggressive tax incentives.

The DFW area in particular has a diversified labor force, with strong growth recently from the technology and services industries. The initial growth of DFW's data center market originated in the downtown area of Dallas. Because the downtown area is rich in telecommunication infrastructure, several office buildings were retrofit to accommodate data center users. Data center growth in Dallas traditionally comes from financial, technology, managed services/cloud, telecommunications, and the healthcare industry.

Largest colocation providers

Measured by total commissioned power

Focused on Dallas/Fort Worth?

Get instant access to market analytics. Guess less. Make better decisions.