By David Liggitt · 10/31/2022

While demand remains high, some larger data center markets across the world are struggling to deliver the power needed to accommodate these requirements, creating a backlog of demand and opportunities for markets historically not accustomed to larger growth. This lack of supply is also pushing data center rental rates higher as there are less options for users in the market.

North American Data Center Markets

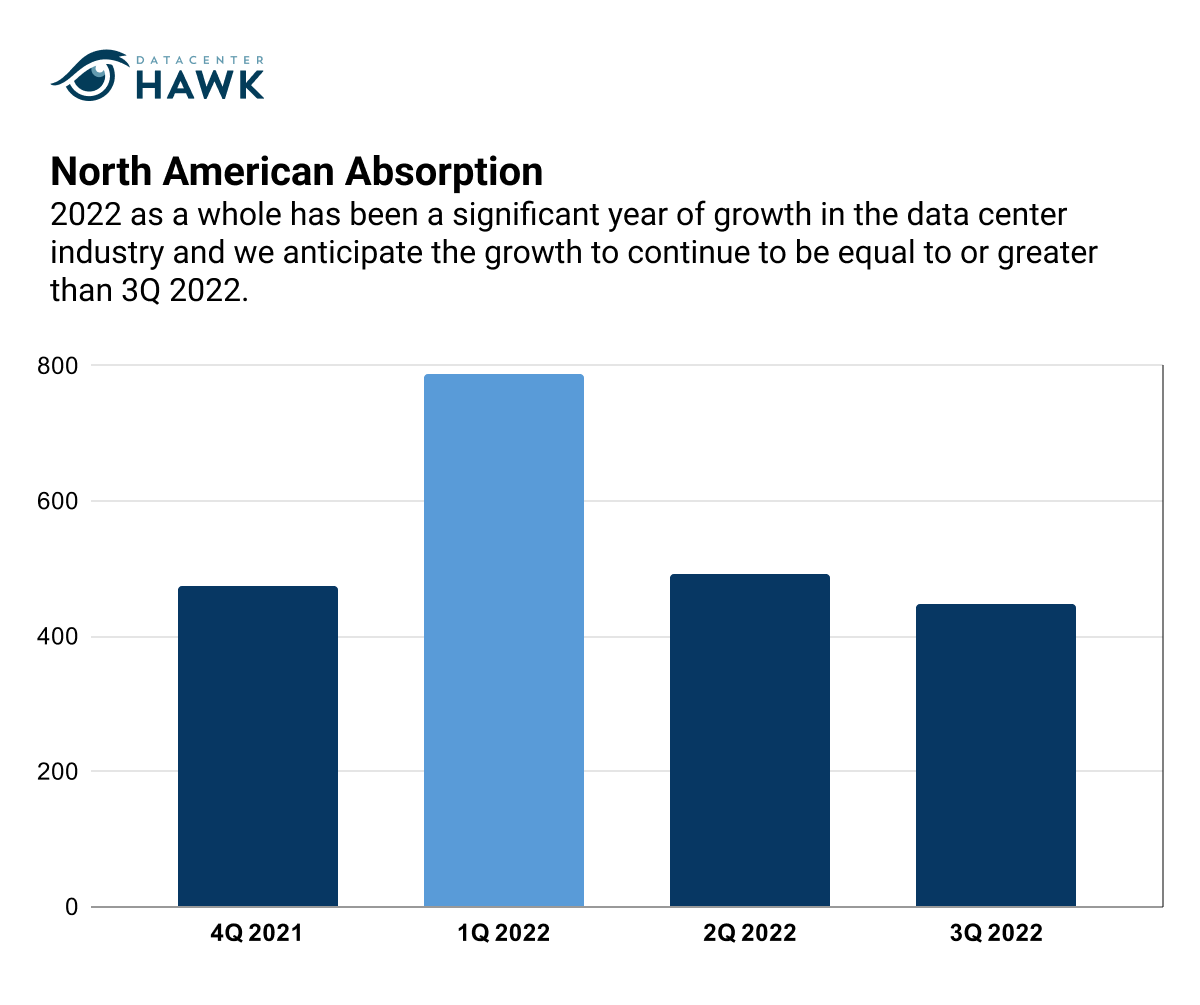

While demand for data center infrastructure remained high in North America, its pace has somewhat cooled. Although the 447 MW of absorption across major North American markets was lower than 2Q 2022, the number was nearly as high as North America’s average annual absorption between 2015-2021. With some limitations arising in major markets, primarily concerning power supply, users are open to looking to markets where power is instead of waiting for power to come available in their preferred markets. As a result, demand in some areas is spreading to markets that had not previously been recipients of hyperscale requirements.

North American Absorption

Notable Trends & Markets

Dallas jumps Northern California to become 2nd largest North American market

Northern California has long held its position as the second-largest data center market in North America, but, due to ample pre-leasing and the challenges with delivering supply in Silicon Valley, was overtaken in 3Q 2022 by Dallas. In 2Q 2022, Dallas was the fifth largest North American market, behind Northern Virginia, Northern California, Phoenix, and Chicago. However, after over 100 MW of absorption recently, Dallas has jumped to take a firm second-place spot. Dallas is an attractive market for enterprise and hyperscale users, with competitive power rates, tax incentives, and a business friendly economy.

Development delays and extended timelines result in lighter absorption

Extending timelines for planned data center projects (for example, from 24 months to 36 months for power to be delivered) has caused a pause in some pre-leasing. Markets where pre-leasing activity has been significant, like Northern Virginia and Phoenix, had less absorption in 3Q 2022 when compared to their historical average. However, strong demand signals are being seen in other primary markets and secondary markets also.

Emerging markets gaining traction with hyperscale companies

Data center demand is outpacing supply in most of the major data center market. Data center users and providers are now less tied to geography and are focused more on where power is available, pushing development opportunities to other places. Markets like Columbus and Salt Lake City continue to gain attention from the data center industry, with many providers and hyperscale companies buying land for new development or expansions.

Looking Forward

Demand in both the US and Canada from enterprise and hyperscale users will continue to be high. Given the low vacancy across North America at 3.4%, new submarket development regions will grow and larger requirements could move from one market to another.

European Data Center Markets

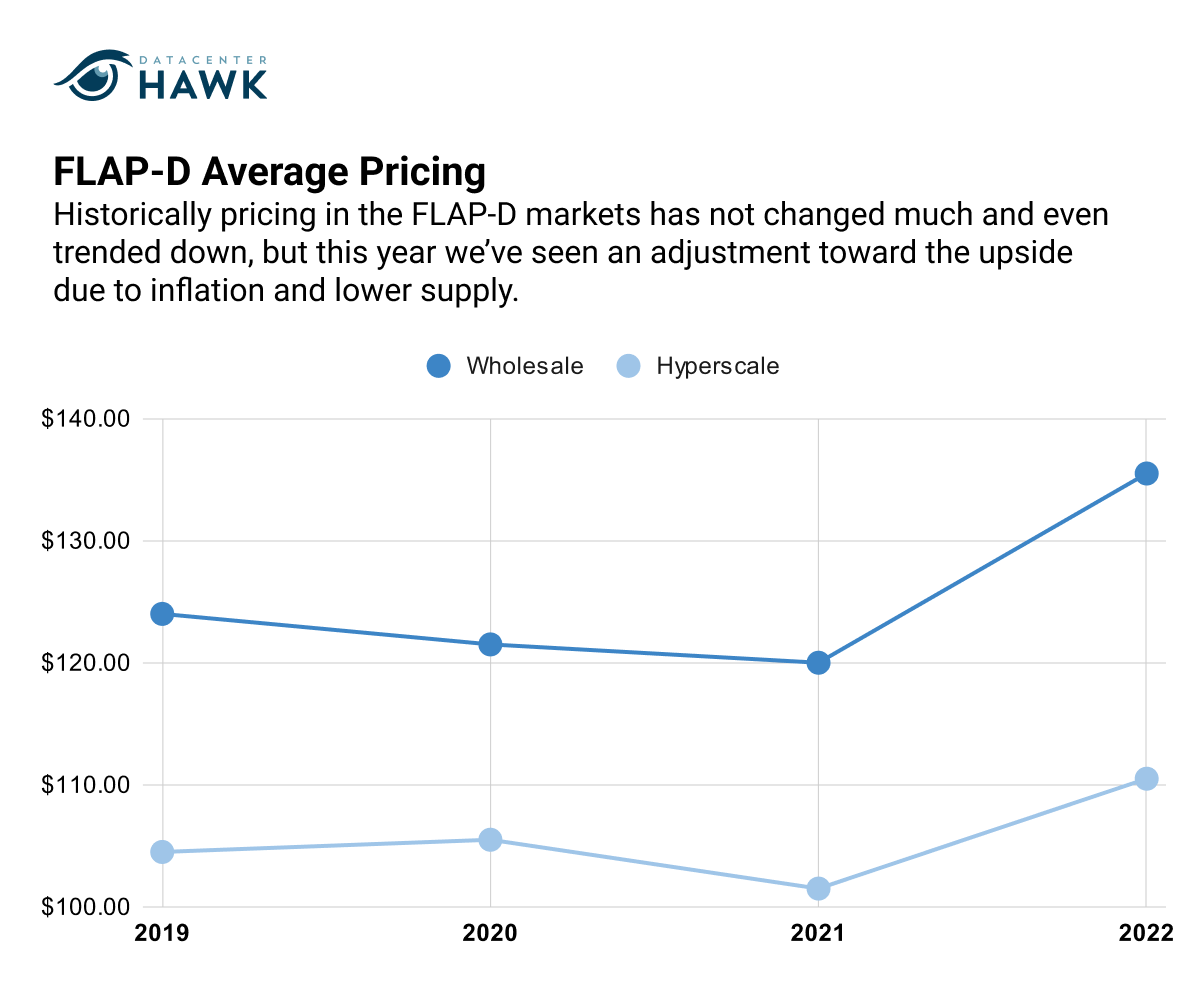

Data center demand was healthy in Europe, both from hyperscale and enterprise users. Although absorption declined in some of the larger European markets, it increased in areas like Amsterdam, Dublin, and Paris. The demand was tied to multiple 3-10 MW leases instead of a few 10 MW+ requirements. Data center material shortages, energy constraints, and currency values are pushing pricing upward, as costs of operating continue to rise.

FLAP-D Average Pricing Over Time

Notable Trends & Markets

Currency volatility impacting rental rates

The value of the Pound and the Euro dipped to one of its lowest levels in 3Q 2022, influenced by post-pandemic economic challenges and obstacles created by the conflict between Ukraine and Russia. For international data center providers in Europe, the currency volatility complicates rental rates as contracts produce revenue. To mitigate inflation, some providers are exploring higher escalation rates, contracts without escalation caps, or lease structures designed to pass cost increases onto the customer.

Providers preparing for winter energy shortages

The ongoing conflict between Russia and Ukraine has limited Europe’s fuel supply and created concerns as winter approaches. Several countries believe their supplies are insufficient for prolonged cold weather and are considering periodic power shut-offs. While some countries have categorized data centers as priority infrastructure, along with hospitals and other emergency structures, providers are stockpiling diesel reserves to ensure uptime during outages.

Looking Forward

The conflict in Ukraine has created material concerns for Europe, having unforeseen impacts that will likely remain in the future. Because the conflict is lasting longer than anticipated, countries are striving to find ways to relieve their energy sources and halt inflation. While this generates a level of volatility in the short term, it also forces necessary efficiency adaptations that will have long-term benefits to the European data center industry.

Asia-Pacific Data Center Markets

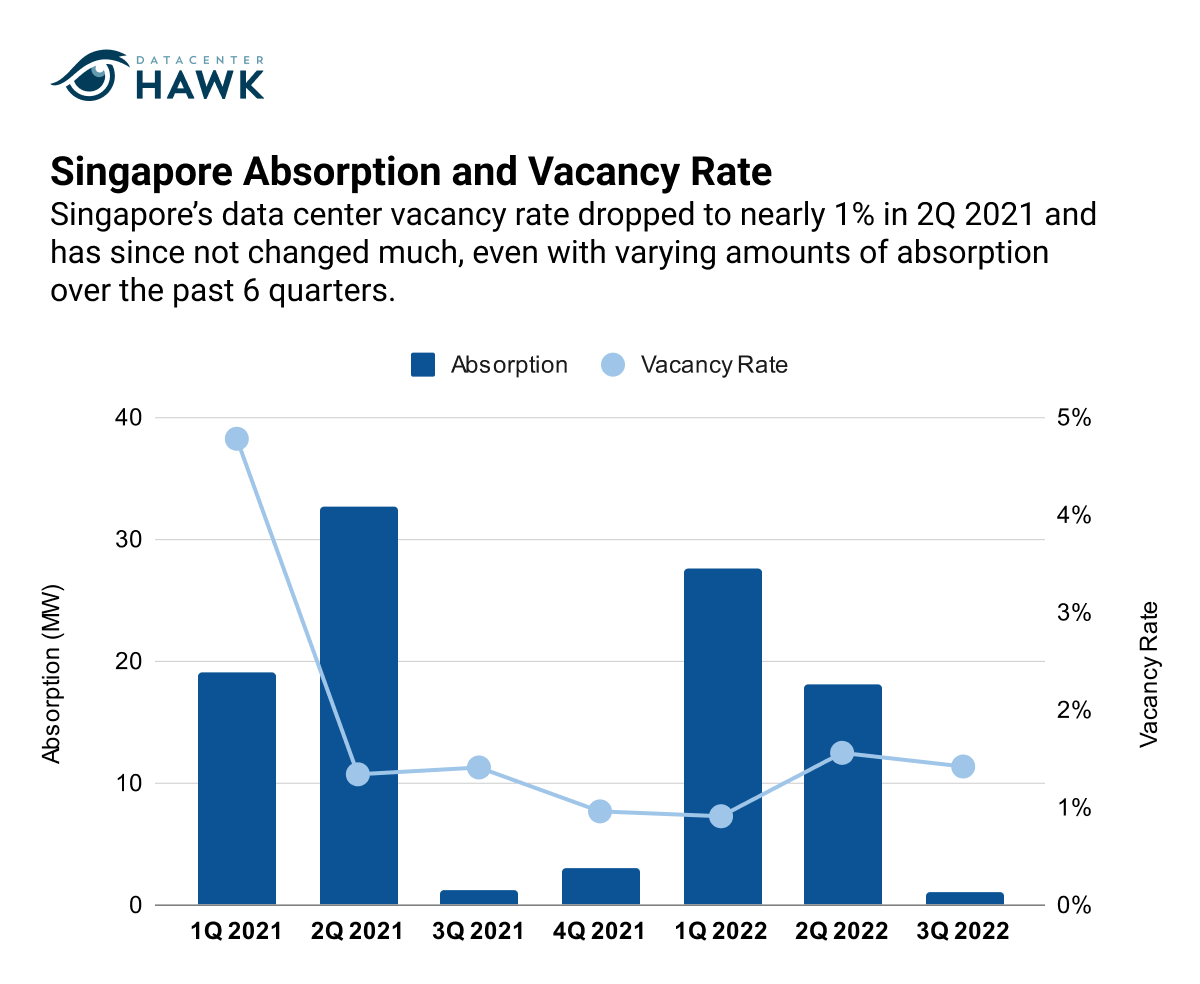

A lack of ready capacity made for a lighter demand period in major APAC markets in 3Q 2022. Singapore, which has a vacancy rate under 2%, is working to enable new capacity to come to the market to maintain its position as the primary data center and connectivity hub for APAC. Australia is also emerging as an area with immense opportunity. The government’s pro-data center stance has attracted data center development across the country, anchored by escalated demand in Sydney.

Singapore Absorption and Vacancy Rate Comparison

Notable Trends & Markets

Singapore easing data center development restrictions

Singapore has temporarily lifted its data center moratorium to enable the development of new facilities that comply with new sustainability measures, strengthen Singapore’s position as a regional digital hub, and advance the country’s economic aspirations. All applications must be submitted by November 2022, with approval granted by March 2023.

Influx of capital from investment funds eager to expand in APAC

The Asia-Pacific region is viewed as an area of ample potential, and investment groups are actively pursuing ways to establish a foothold in the region’s data center industry. In 2022, over 10 major data center investments and funding events have occurred in Singapore, Hong Kong, and Sydney, not including major acquisitions of portfolios and properties by data center providers. Activity is also high in the rest of APAC, with major funding taking place for projects in Japan, South Korea, Australia, and other emerging APAC markets.

Looking Forward

Development in APAC will continue to escalate, due to the growing demand for data center capacity and the volume of new capital becoming available. While much of this will occur in markets like Sydney and Singapore, limited supply will push development toward other APAC markets. This trend is helping Tokyo transition from serving primarily domestic demand to becoming a major global data center market. Other emerging markets like Osaka, Seoul, Kuala Lumpur, and Jakarta will also benefit.