By Stephen Schlenker · 3/8/2021

While Silicon Valley is the epicenter of big tech, when it comes to the infrastructure required to support their digital products, more companies are fulfilling their expansion needs at data centers just outside the Golden State.

West coast options Portland, Las Vegas, and Phoenix all offer attractive alternatives to both leasing and building data center infrastructure when compared to California. Although each market has unique advantages, Phoenix is in a position to capture the largest market share primarily due to the hyperscale demand in the market.

Hyperscale developments pull colocation providers to Phoenix

As hyperscale users are both leasing and investing in their own data center infrastructure, Phoenix presents an option to accommodate their long-term growth.

Microsoft’s recent investment in their Goodyear campus will shape the overall strategy of their IT infrastructure plan moving forward. Similarly, Google's recent growth plans are significant in shaping data center development in Mesa, a city located on the East side of Phoenix.

One of the trends seen with hyperscale data center development is clustering, which allows data center users to take advantage of the infrastructure and connectivity that is already in place. Many believe the Phoenix data center market has similar growth opportunities as Northern Virginia, where hyperscale development is at its highest.

Future data center development projects drive up planned power

Phoenix has several colocation facilities under construction and a strong pipeline of planned projects that are waiting to begin.

Some of the notable projects currently under construction in Phoenix are from Aligned, Compass, and Iron Mountain. CyrusOne, EdgeCore, NTT, Stack, Stream, and Vantage also have and/or are planning large campuses in the area as well.

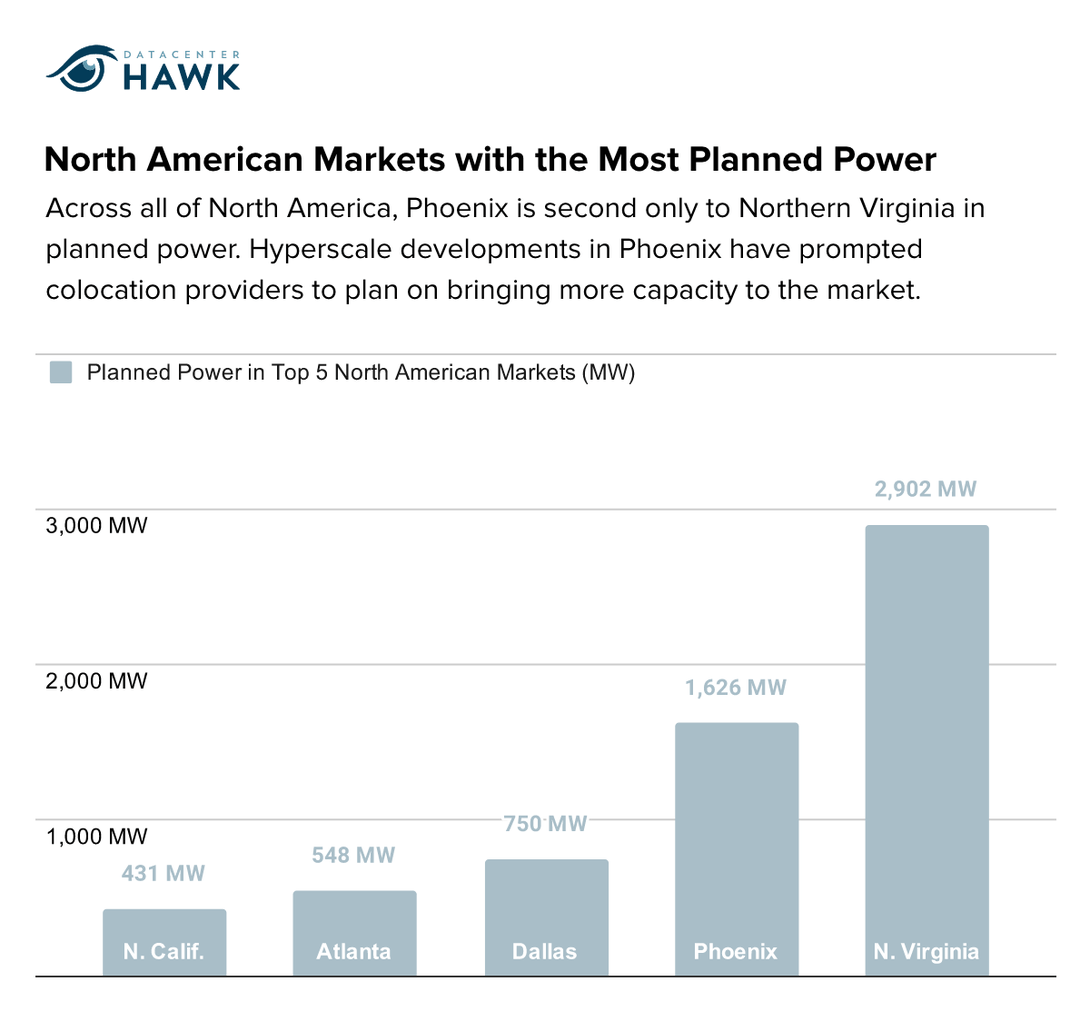

In fact, Phoenix is second only to Northern Virginia in planned power across major North American data center markets.

Phoenix economic cost for data center users remains low

The economic cost of having IT infrastructure in Phoenix is relatively inexpensive.

The number of quality options from the numerous providers in the market leads to elastic demand, where the price point is the most important factor when users are choosing a data center location. Other typical decision factors for most users, including the data centers' location within the market, are not nearly the decision driver in Phoenix that it can be in markets like Chicago or New York.

Given the continual focus on the importance of renewable energy in the data center sector, the city of Phoenix has completed several clean energy projects to accommodate data center developments focused on environmentally friendly solutions.

Favorable tax incentives are another factor instrumental in data center users wanting to locate in Phoenix. The Arizona Commerce Authority has a program that incentivizes companies that colocate in Phoenix with a 20-year sales tax exemption. These savings can help offset the expensive investment required on the front-end cost of digital infrastructure.

Summary

Phoenix has the advantage of low operating expenses and the gravitational pull of hyperscale users investing in the market.

As the Phoenix market continues to grow in 2021, follow along with datacenterHawk’s Insight tool, offering industry-leading analysis and absorption data on all top data center markets.