By Luke Smith · 3/8/2016

Over the past three years, the San Antonio data center market has evolved to provide a home to both enterprise and colocation/cloud data center users. This smaller, somewhat quiet data center market attracts both types of users because of the city’s favorable data center characteristics and the maturing colocation market recently created by Stream Data Centers and CyrusOne. San Antonio now finds itself a dual threat, able to lure different types of data center users as well companies from inside and outside the region.

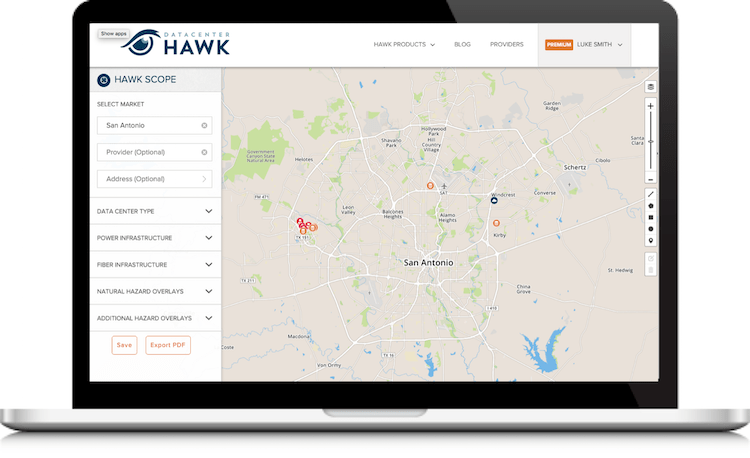

San Antonio Market Characteristics

San Antonio is attractive to data center users because of the robust infrastructure (power/fiber), reasonable power cost, tax abatement opportunities and low natural disaster risk. Most major data center development in San Antonio occurs in the Westover Hills area of the city. Westover Hills is connected by numerous fiber providers, including AT&T, Level3, Time Warner Telecom and Time Warner Cable (to name a few). Google Fiber is also in process to bring their fiber infrastructure to the city, delivering ultra high speed connectivity. The infrastructure in San Antonio is also seen as a plus to data center users. Power provided by CPS Energy is done so at a reasonable rate, and San Antonio utilizes gray water, or waste water, that is repurposed instead of sent to a treatment facility. Larger data center users requiring significant amounts of water for cooling use this recycled water to cool their critical systems at a lower cost, creating a lesser impact on the local water supply. This is one of the reasons why Microsoft chose to build their data center in San Antonio, which consumes roughly eight million gallons of water per month. San Antonio also is home to Rackspace, a leading cloud service provider, with a large presence in the north east section of the city.

What’s driving San Antonio’s Recent Data Center Growth?

Several factors lead to the recent growth of the San Antonio data center market:

- The Low TCO – San Antonio is home to several companies that built and own their data centers. Why did they choose this path? Enterprise users all have different reasons, but central to the decision making process is the low total cost of ownership. San Antonio is an area playing well for large data center requirements, with reasonable power cost, tax incentives, and infrastructure investments created for savings. Microsoft, Frost Bank, Christus Health, Lowe’s and the NSA all own and operate data centers in the Westover Hills area. Although the number of companies owning their data center infrastructure is decreasing, San Antonio remains a solid option for companies that still employ this strategy

- Colocation Investment – Colocation investments made by Stream Data Centers and CyrusOne are catalysts to the current market activity in San Antonio. Both companies delivered quality facilities and solutions designed to meet the needs of data center users today. They now provide a strategic option for these users that previously did not exist, as well as a competitive environment to ensure the best economic solution is achieved.

- Large Companies, Large Requirements – Large companies preferring to own their data centers can also have colocation needs. Some of these users want greater flexibility, or struggle to meet timelines for critical projects. This creates the need for on time solutions in markets they are already in, and both Stream and CyrusOne’s San Antonio facilities are set up to accommodate.

- Regional and Local Outsourcing – South Central Texas companies with outsourcing needs now have credible options from a colocation and cloud perspective. This can often change the outlook and activity of market users who have always been pushed to larger Texas markets (Dallas, Austin, Houston). They now have solid solutions in their own city.

Recent San Antonio Market Activity

Microsoft is the dominant name in the San Antonio market. In 2008, the technology giant built a 477,000 SF enterprise owned data center in Westover Hills, and the company is currently growing in the market. In 4Q 2015, Microsoft announced the purchase of 158 acres of land in the west part of the city, which is planned to hold eight data center facilities over the next few years. A significant amount of the growth in the San Antonio market as of late can be tied to Microsoft’s expansion.

The colocation market is expanding in San Antonio as well. Although smaller in size to other Texas markets (Dallas, Houston, and Austin), both Stream Data Centers and CyrusOne are investing heavily here, offering an attractive option for companies both in San Antonio, South Central Texas, and outside of the region.

In 4Q 2014, Stream Data Centers delivered their 75,000 SF, purpose-built data center facility, offering up to 7.2 MW of critical load to end users. “Stream has leased space to a leading technology firm, and also seen good activity from several large San Antonio based companies” said Michael Lahoud, Senior Vice President with Stream Data Centers. The LEED Silver certified data center offers dedicated infrastructure for users, and power to the facility is fed by two separate substations.

CyrusOne purchased and developed their first San Antonio data center in 2012 at 9999 Westover Hills Blvd. After leasing the 107,000 SF facility to several users, the company began development on their most recent San Antonio offering. In 4Q 2015, CyrusOne announced they pre-leased the first two phases of their second data center in San Antonio. This is one of the largest colocation transactions in the history of the San Antonio market.

What do companies benefit from the San Antonio Data Center Market?

Data center markets typically grow organically, and San Antonio’s economic environment is poised to help accelerate the growth. The business friendly economy is rooted in numerous industries, including aerospace/aviation, bioscience/healthcare, financial services, manufacturing, military/defense, and technology. San Antonio’s workforce in June of 2015 was approximately 1.1M, with an unemployment rate of 3.8% (approximately 42,000 people), compared to 4.6% for Texas and 5.6% in the greater United States. Local area colleges and universities graduate approximately 25,000 students entering the workforce each year. In addition, San Antonio can be evaluated by companies looking for data center solutions nationally as well. San Antonio is a competitive market, and compares favorably when evaluating the total cost of ownership, given the reasonable power cost and attractive tax incentives. Users in both the colocation/cloud and enterprise data center user market find these characteristics attractive.

The Future for San Antonio

As technology strategies change for companies in the future, the San Antonio market is positioned well to provide a home and multiple options for data center users. In addition to attracting large enterprise companies, San Antonio can now lure colocation users because of the investments made by Stream Data Centers and CyrusOne.