By Luke Smith · 3/17/2016

CyrusOne ended their fiscal year with momentum, fully pre-leasing a large data center project in northern Virginia and the next two phases of their San Antonio campus. The momentum is continuing. On Tuesday, CyrusOne announced a sale-leaseback agreement with the CME Group for their data center in Aurora, Illinois for $130 million. Here are the three reasons why CyrusOne’s large acquisition matters:

#1 CONE Establishes Presence in Another Primary Data Center Market

CyrusOne is actively expanding across the United States, and this acquisition puts them in another major data center market. Providing services as a data center operator across major markets is critical in accommodating client growth, and this solidifies their position in the Windy City for years to come. CyrusOne currently has facilities in the following primary markets: Chicago, Dallas, Northern Virginia and Phoenix (classified as primary by datacenterHawk), as well as other secondary markets across the United States. We anticipate CyrusOne to purchase additional facilities in other primary markets in the near future.

#2 Speed to Market in Chicago Important, and CONE can compete today

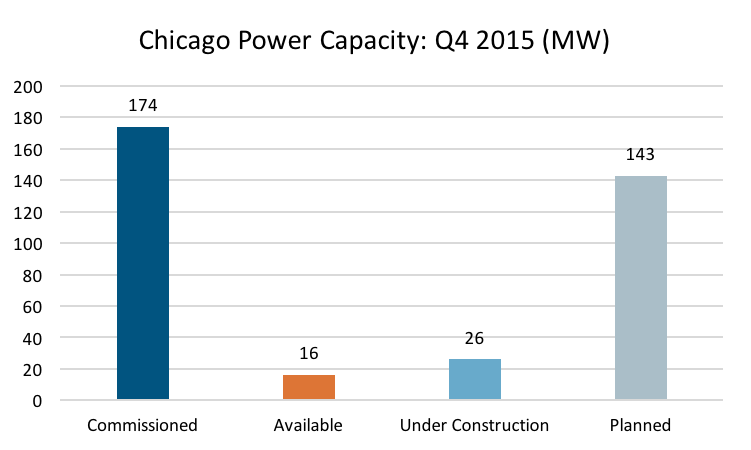

The Chicago data center market is expanding rapidly. Activity is buzzing in Chicago because of the large number of businesses located in the market, the competitive colocation/cloud environment, the reasonable power cost, and the low risk of natural disasters. Chicago has 143 MW and over 666,000 SF of planned data center power and space capacity in the development pipeline, meaning providers are expecting future growth in the market. Digital Realty and DuPont Fabros both have existing facilities (mostly full) and are expanding because of anticipated new growth. The CyrusOne acquisition allows them to provide capacity to users today, with 36,000 SF of commissioned data center space available now. The 428,000 SF facility also provides opportunities to grow internally and is accompanied by 15 acres of developable land for the future

#3 CME Acquisition gives CONE Opportunity to Further Grow Financial Industry Vertical

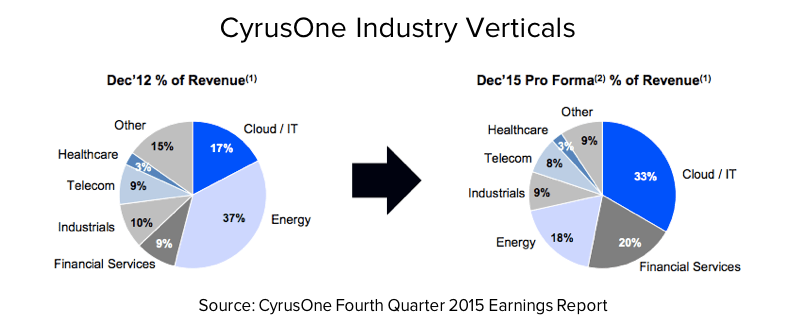

CyrusOne’s business started from relationships with several companies in the energy industry, and the company has worked over the last few years to diversify their revenue mix. For instance, 37% of CyrusOne’s 4Q 2012 revenue was directly tied to the energy sector, compared to only 9% of the financial services sector. In 4Q 2015, CyrusOne’s revenue from the energy sector decreased to 18%, and their financial services revenue increased to 20%. The agreement with CME Group provides another opportunity to further diversify the revenue mix and offer similar services to other financial users interested in outsourcing their IT infrastructure.

CyrusOne is consistently making moves to prove they are a top data center provider. It is likely they will continue to expand into new markets in the near future.