By Luke Smith · 1/19/2016

Phoenix is the sixth largest data center market in the United States, and demand over the past few years has been consistent largely due to companies both in and out of the city with data center requirements. The Phoenix market provides a home for both enterprise companies seeking to own and operate their own data centers and colocation users wanting to outsource their requirements. Data center users find the Phoenix market favorable because of the following reasons:

1. Competitive Colocation/Cloud Environment – Quality colocation and cloud providers have invested significantly in Phoenix over the past few years, creating a competitive market for data center users

2. Low Natural Disaster Risk – The city has almost no history of damage associated with seismic events, tornadoes, or flooding

3. Inexpensive Power Cost – A diverse fuel mix and competition from several power providers create a reliable and competitive power environment

4. Tax Abatement Opportunities – Legislation passed in 2013 enhances the state's ability to compete on large, national data center requirements

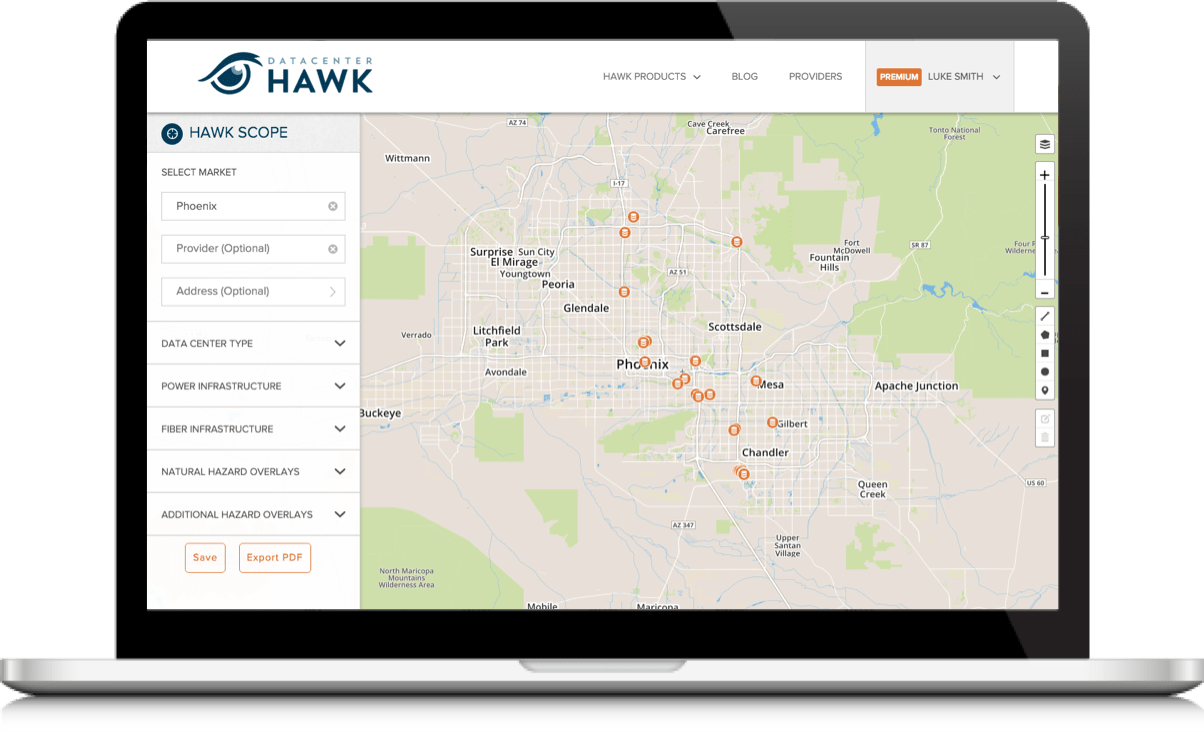

Data center development in Phoenix occurs in both downtown, where several large carrier hotels and colocation facilities reside, and the outer suburbs. The trend of building outside the downtown area is seen in other primary data center markets as well, including Northern Virginia, Silicon Valley, Dallas, Chicago, and Northern New Jersey. Data center operators moved in this direction to provide purpose built facilities that are efficient, cost effective and a better product. Chandler, AZ is a smaller city outside of Phoenix and has been a recipient of the move to the suburbs in the Phoenix market, with several providers recently developing there.

Here is a quick look at activity around Chandler and the greater Phoenix market:

- Aligned Data Centers – Aligned is under construction with their first pay-for-use model data center in the Phoenix market. Phase I is planned to provide up to 14 MW of commissioned power while guaranteeing 1.15 PUE. It has four separate 69 kV utility feeds provided by the Salt River Project (SRP) and a dedicated on-site substation

- Digital Realty – Digital has been in the Phoenix market for a long time. The company worked hard over the last few years to fill existing capacity located in downtown Phoenix (at 120 E Van Buren) and 2121 South Price, their other large investment in Phoenix. DLR originally purchased the facility in 2010 with plans to expand. The 519,000 SF data center has delivered 32.6 MW of commissioned data center power. Digital Realty has three other locations designed as development opportunities in the Phoenix market as well

- CyrusOne – The Dallas based colocation provider purchased their Chandler development site in 2012 and has delivered three data center facilities on the campus. They can develop additional capacity and facilities fed by an onsite substation

- H5 Data Centers – The Denver based company recently purchased the NextFort facility at 2600 W Germann Road in Chandler and plans to offer up to 30 MW when fully delivered. The building is in close proximity to both Digital Realty and CyrusOne's Chandler offerings

- ViaWest – ViaWest entered the Phoenix market in Q1 2014 after purchasing a data center owned and operated by Cox Communications. Cox remained in the facility as the anchor tenant, and ViaWest converted the additional data center footprint to multi-tenant use. ViaWest can deliver 42,500 SF of commissioned data center space, and will provide up to 5.4 MW of commissioned power at full build

- Other Phoenix Providers: 365 Data Centers, CenturyLink, EdgeConneX, Fortrust Data Centers, I/O, PhoenixNap, & QTS