By Erica Hashert · 12/22/2020

Chicago data center market activity is increasing because of renewed interest from large users, new state tax incentives, and a competitive market.

Those paying attention to trends within the US data center industry will not have missed the rise in development in one its most prominent markets – Chicago.

Chicagoland has been the subject of increased data center interest from both enterprise and hyperscale users, particularly in recent years.

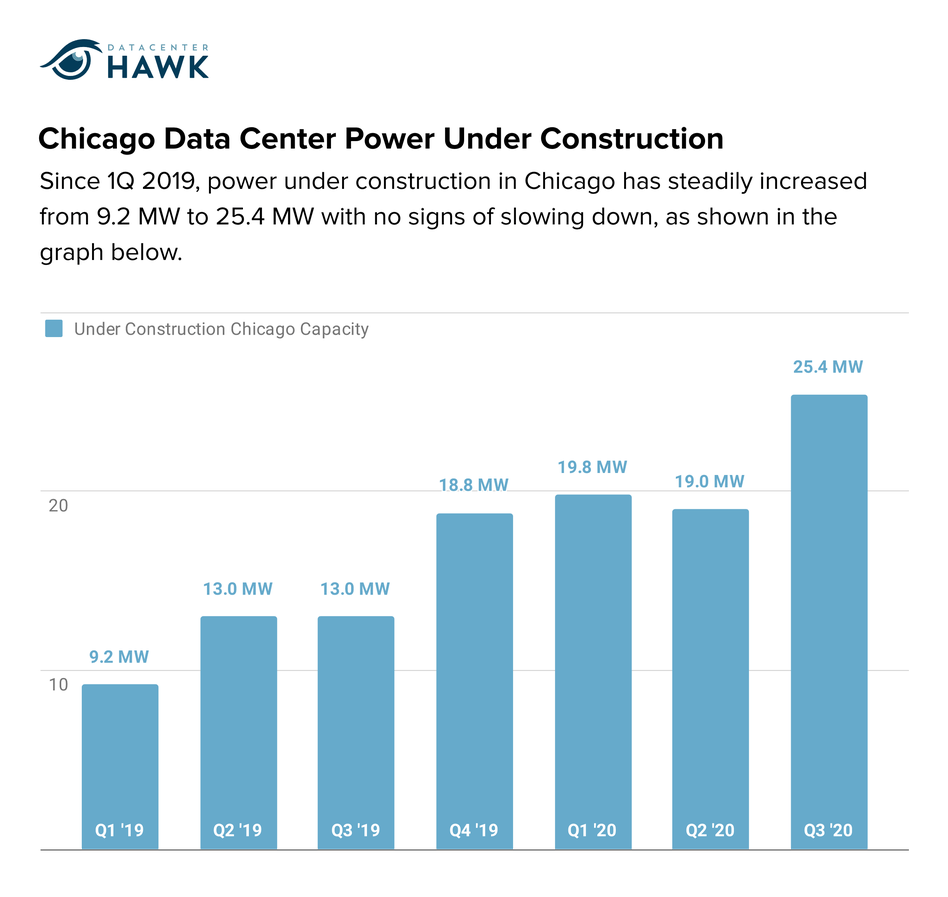

Since 1Q 2019, power under construction has steadily increased from 9.2 MW to 25.4 MW with no signs of slowing down.

Three trends are influencing the Chicago market and predicating the steady rise in construction activity in recent years. Renewed interest from large users, enaction of state tax incentives, and the creation of a healthy competitive market have positioned Chicago for a growth in new data center offerings.

Renewed interest from large users

Increased demand from large users is stimulating the Chicago data center market. As users look to offload their IT operations, colocation and hybrid solutions require larger amounts of power and space to meet customer needs.

Some notable activity in the market includes:

- T5 purchased a 164,000 data center shell in 1Q 2020 and is under construction with an initial 4.4 MW to serve enterprise and hyperscale cloud computing customers.

- New market player Digital Crossroad is currently under development with a 10 MW facility in Hammond, Indiana, located 25 miles from Chicago.

- NTT Global is nearing completion on the first phase of their 36 MW Itasca data center, with plans to construct another 36 MW facility directly adjacent.

- Facebook is also in the planning stages of another 907,000 SF facility in DeKalb, IL, in west Chicago.

- The region is not lacking cloud computing power, however, with facilities like Microsoft’s 707,000 SF Northlake facility and a recently-acquired 37 acres in Elk Grove Technology Park.

Factors such as moderately low power costs and rich fiber density attract these larger users to the Chicago metro. The presence of major trading exchanges draws financial services corporations as well. There is also speculation the proposed tax on financial transactions in New Jersey could drive established trading exchanges out of the Northeast, with Chicago discussed as a possible relocation site.

Enaction of state tax incentives

Another reason for the increase in Chicago market activity is the impact of the recently enacted tax incentives in Illinois.

Formerly claiming a sales tax rate of 10%, Illinois was at a competitive disadvantage to the thirty other states offering tax exemptions for data center developments.

To qualify for the new tax break, operators must invest a minimum of $250 million in the facility over a period of five years, and new facilities are required to build in accordance with green building standards and employ at least 20 local employees. The tax breaks will exempt providers from state and local sales tax on infrastructure for 10 years, with a further 20% discount for new developments in low-income areas.

The creation of a competitive market

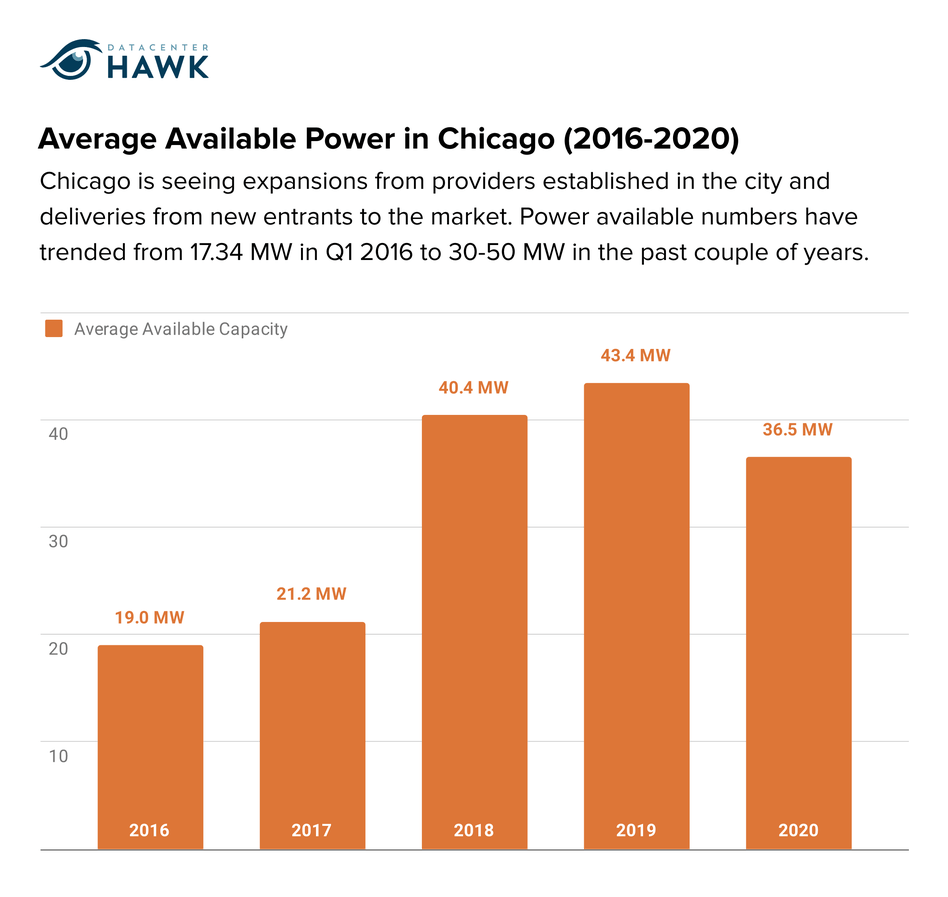

As a result of the anticipated demand coming to the Midwest, Chicago is expanding from providers established in the market and deliveries from new providers.

Average available power in Chicago has increased over the past several years, illustrating anticipated demand data center operators believe is headed for the market.

Chicago has become a highly competitive market - both in terms of availability of commissioned power to keep up with demand, and in the aggressive pricing and services delivered to the end user.

In other words – a highly competitive region ushers in greater demand that leads to more competition.

No signs of slowing down

The Chicago market is growing, both in IT power delivered to the market and in projects currently under construction. Three factors have contributed to this steady growth, namely, interest from large users, recent tax incentives, and a healthy competitive edge.

As one of the top five data center markets in the US, the Chicago metro shows no signs of slowing down.

If you’d like to see how the Chicago data center market trends over the next quarter, sign up for a friendly reminder of our next release of market data.