By Luke Smith · 4/12/2016

Leasing both colocation and cloud solutions has increased in popularity over the last five years. Today, both of these options provide significant advantages for the right size and type of data center user. The leading cloud providers, like Google, Amazon, and Microsoft are seeing rapid expansion as more and more companies are moving their infrastructure to the cloud. Jeff Bezos, Amazon CEO, says that Amazon Web Services alone is projected to reach over $10 billion in sales in 2016. Forrester analyst, John Rymer, says that companies moving their operational applications into the public cloud is a big deal. In the past, many companies said they'd never see themselves moving operations in to the cloud, but now that's the place companies want to be. As evidence of market growth from 2014 to 2015, six of the publicly traded data center providers’ (CoreSite, CyrusOne, Digital Realty, DuPont Fabros, Equinix, and QTS) revenue grew at an average of 19%, indicating most organizations are moving on-site IT infrastructure to colocation and/or cloud solutions provided by many of these operators.

In addition, these top six companies mentioned above are investing in facilities and services to accommodate the growth. For example, Equinix announced earlier this year their Interconnection Oriented Architecture (IOA) strategy, which is designed to triple their customer base in five to ten years and is heavily focused on enterprise users. Digital Realty signed $36 million worth of new leases in 4Q 15 and is actively expanding in major markets (Chicago, Dallas, Northern California, and Northern Virginia). CyrusOne leased a record 49 MW in 2015, increasing their revenue 21% from 2014. QTS currently has 91% of their commissioned data center space leased, with an additional 125,000 SF coming to the market in 2016. In March, DuPont Fabros announced new leases totaling over 27 MW in their Santa Clara and Chicago data centers, in addition to the 47 acres they recently purchased in Hillsboro, Oregon. The market is growing, and in addition to these companies expanding their campuses, they are also providing greater access to connectivity, cloud and other services designed to accommodate data center user needs in 2016.

These investments being made by the top providers are an effort to accommodate the predicted growth coming to the market, as described below.

- Over the next five years, the colocation market is expected to grow from $25B to $51.8B, according to a new report from Allied Market Research

- Knowledge Sourcing Intelligence estimates that the data center colocation market will witness 14.45% growth each year.

- According to Forrester Research, the public cloud is a "hyper-growth" market which will grow to $191 billion by 2020

Why are organizations continuing to entrust IT infrastructure to third party operators across the world? For the upcoming datacenterHawk Blog Series titled “5 Reasons Companies Lease Data Centers,” we evaluate the advantages to colocation and cloud as a solution by looking at the following aspects:

- Reason 1: The Economic Advantage

- Reason 2: The Flexible Solutions

- Reason 3: The Scalable Options

- Reason 4: The Competitive Market

- Reason 5: The Time Savings

Reason 1: The Economic Advantage

To ensure the strategic data center decision is made for an organization, companies should evaluate multiple options that can accommodate their needs. Even though the economics of these solutions are not the only item to be considered, the financial picture is a main component worthy of evaluation. Because of the maturity of the colocation and cloud market, most companies now end up recognizing that colocation and cloud solutions provide economic advantages when compared to the alternative of owning their own data center.

A Smaller Up Front Investment

Leasing a data center requires a smaller up-front investment from the end user. If a company wants to pursue a data center ownership scenario, it requires capital to build the solution. By outsourcing, companies are not obligated to pay the up-front money needed to bring the solution to life. These companies are required to pay rent to the data center operator, but it is allocated in steady payments over time and provides financial flexibility with the capital saved on the front end of the process. Building a data center is an expensive endeavor. After buying a site, connecting it to power, fiber, and water infrastructure required for the project is costly. Further, constructing the data center shell and purchasing and installing the equipment (UPS systems, generators, PDU’s, chillers, etc.) needed to run the facility adds significant cost. Conserving this capital by leasing provides greater financial flexibility for most companies, including the opportunity to invest the money over time in their own business instead of immediately in their own data center. Repositioning the up front cash required to build a data center through leasing is a credible economic advantage for the right sized company.

The Lease Accounting Advantage

When a company leases their data center from a third party operator, this lease obligation is counted as an operating lease and only reported in a company’s footnotes of financial statements. This means they don’t apply to the overall balance sheet and presents a more advantageous financial picture for the company.

However, this advantage could be changing. One recent alteration data center users should be aware of is tied to the new rule released by the Financial Accounting Standards Board (FASB) in February of 2016, to be enacted in 2019-2020. The new FASB rules would essentially transfer these operating leases to the balance sheet, potentially creating a much different financial picture for companies using leasing as a strategic solution. While the details of these new rules are still emerging, it’s important for data center users to understand as they evaluate their upcoming strategy.

The Value of Economies of Scale

Leveraging a data center operator’s economies of scale creates another economic advantage. Users directly benefit from the size of large data center operators who frequently leverage their position by creating cost advantages related to facilities, power cost, and operations. As the data center market is maturing, the cost to build a data center has decreased through efficiency. As an example, CyrusOne recently revealed to investors it costs them less than $6.5 million per megawatt (MW) to deliver their infrastructure, which is a dramatic difference when compared to the $11 million/MW spent by CyrusOne in 2010. Other major providers have decreased their cost of delivery as well, allowing more affordable pricing for their customers.

Data center users also save money by leveraging the power cost data center operators have negotiated with power companies. Most operators own multiple locations in multiple markets and leverage their position regionally to ensure the lowest power cost can be attained. These low costs are typically provided to customers as a direct pass through based on consumption (important to note this usually occurs with requirements greater than 100 kW). With electricity being a such a large component of operational cost for data centers, procuring power cost at a lower rate is a welcomed economic advantage leasing provides.

A data center provider's expertise in operating data centers typically translates into lower operational costs passed along to end users. Operating costs of the data center provide users a cost savings option, as data center providers typically operate their facilities more efficiently than end users because they have deep experience.

Truly Understand the Cost

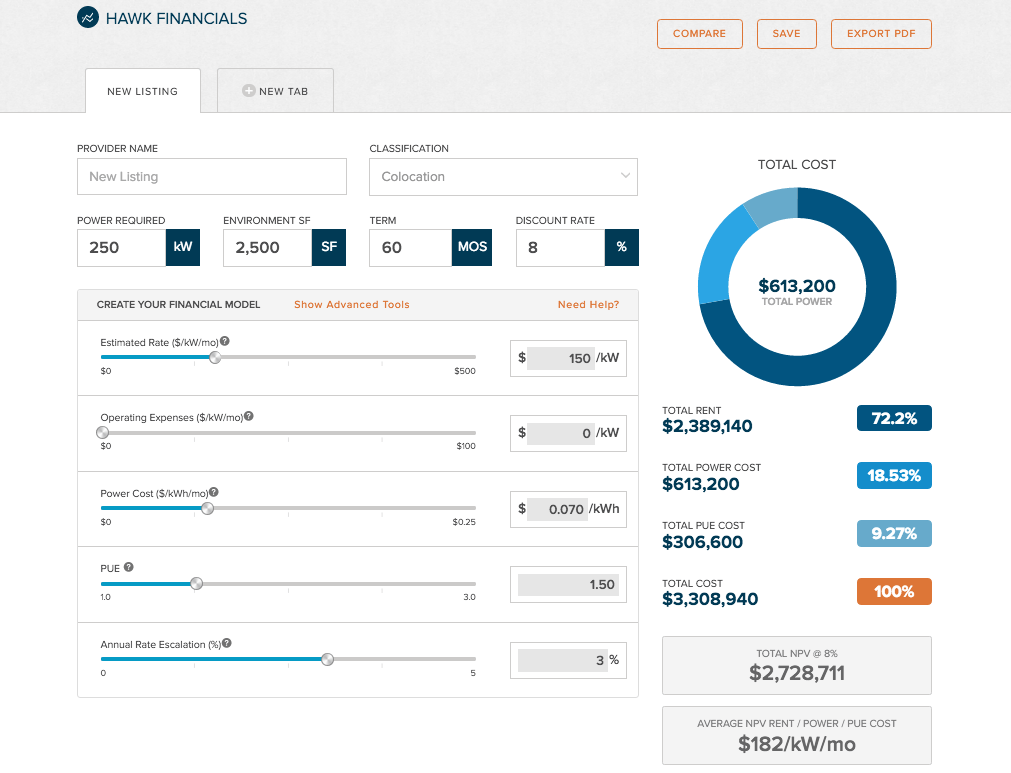

One effective way to truly understand why companies lease data centers is to evaluate the detailed economics of the total cost when compared to an ownership scenario. Grasping the differences between a lease and owned scenario can be accomplished quickly to guide strategic direction. We built our pre-tax Financial Tool at datacenterHawk to do just this. While a company might need to debate the fundamental risks of leasing and owning internally from a philosophical perspective, they don’t need to from a financial side of things. Our tool can give you answers very quickly through evaluation of rental rates, power cost, PUE, escalation rates, MRC/NRC, and construction costs.

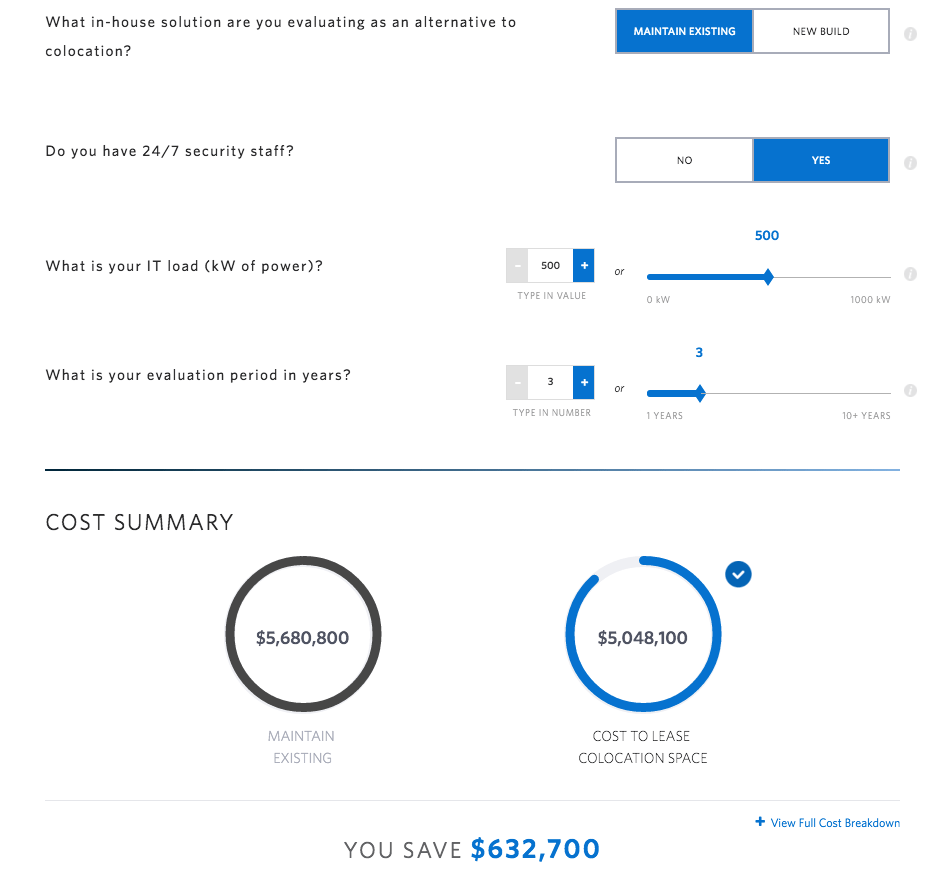

Other tools are also very effective at showing some basic differences. Data center operators are now working hard to help display the financial differences as well. CoreSite recently released their new colocation calculator, allowing a user to compare the costs behind maintaining/building new infrastructure compared to leasing it from a data center operator. It then calculates the dollars saved between the two solutions. To learn more about CoreSite's colocation calculator, visit http://www.coresite.com/resources/resource-library...

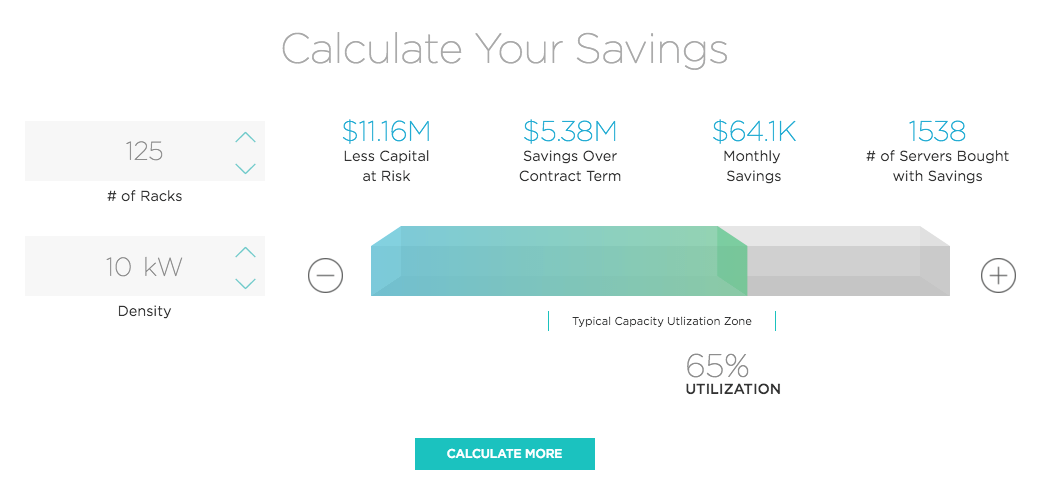

Aligned Data Centers released a comparison tool that allows a user to calculate savings based on the utilization percentage of the infrastructure. Aligned is focused on allowing users to pay for what they actually use. Aligned has data centers in Dallas and Phoenix, and is currently working to expand in additional markets throughout the United States. To see more about Aligned's savings calculator, visit http://www.aligneddatacenters.com/pay-for-use-mode...

Why All Companies Don’t Lease Data Centers

While leasing a data center provides a more cost effective economic solution for most data center users, some companies are better off traveling the path of ownership. Organizations with a large enough critical load can justify the spend to own their data center (typically companies with requirements of 7.5 MW or greater). Specific examples include Amazon Web Services, Facebook, Apple, and Google. These companies are industry leaders in building and operating data centers around the world.

Some companies simply can’t leverage the lease option because of regulations tied to their industry. Healthcare and government data center users struggle with compliance issues, causing a barrier to acceptance despite the colocation/cloud industries growth in compliance adherence.

Bad experiences with past data center operators also lead companies down the ownership route. While the industry has improved and services are tailored more to the user today than ever before, it’s not uncommon to hear from a company that experienced an unfortunate set of events that excludes leasing as a strategy.

While leasing might not be the ideal solution for every company, most companies find colocation, cloud, or hybrid solutions to be the perfect fit for them. Owning infrastructure has its benefits, but the substantial cost-savings of leasing outweigh the benefits of ownership. The colocation and cloud market has seen tremendous growth over the past few years with providers consistently increasing revenue year after year. As more companies adapt to the cloud or colocate in an existing data center, this growth will likely continue.