By David Liggitt · 4/23/2020

This article is a free preview of Hawk Insight, a quarterly release of datacenterHawk’s market research product for data center professionals.

With Hawk Insight, you can easily access the latest supply, vacancy, absorption, pricing, and trend information for 20+ data center markets across North America and Europe. If you want more data and analysis like this article, you can subscribe to our monthly update, sign up for a free trial, or chat with us to get the data you need.

Markets Grow Faster & Planned Power Increases

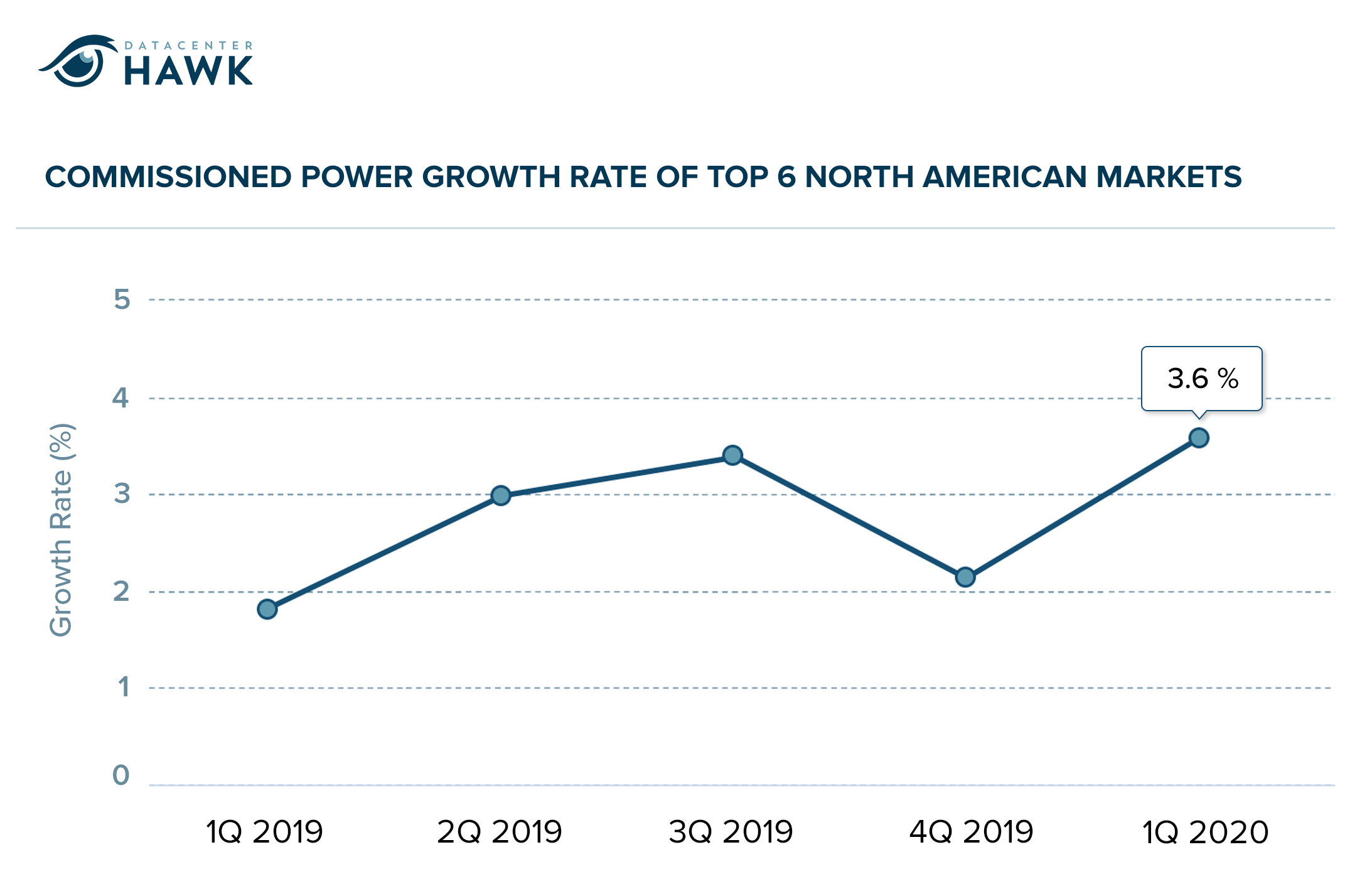

In major North American markets, the “commissioned power” metric (measuring data center power delivered to be leased/or has been leased in a market) grew 3.6% during 1Q 2020, outpacing the 2.6% average quarterly growth of the preceding twelve months. In Europe, major markets grew 4.5% during the first quarter of 2020. Much of the North American and European growth is due to construction deliveries landing in 1Q 2020 and pre-leasing also completed in the quarter across different markets.

In 1Q 2020, commissioned power grew 3.6% in the top 6 North American data center markets.

In 1Q 2020, commissioned power grew 3.6% in the top 6 North American data center markets. (Atlanta, Chicago, Dallas/Fort Worth, Northern California, Northern Virginia, and Phoenix)

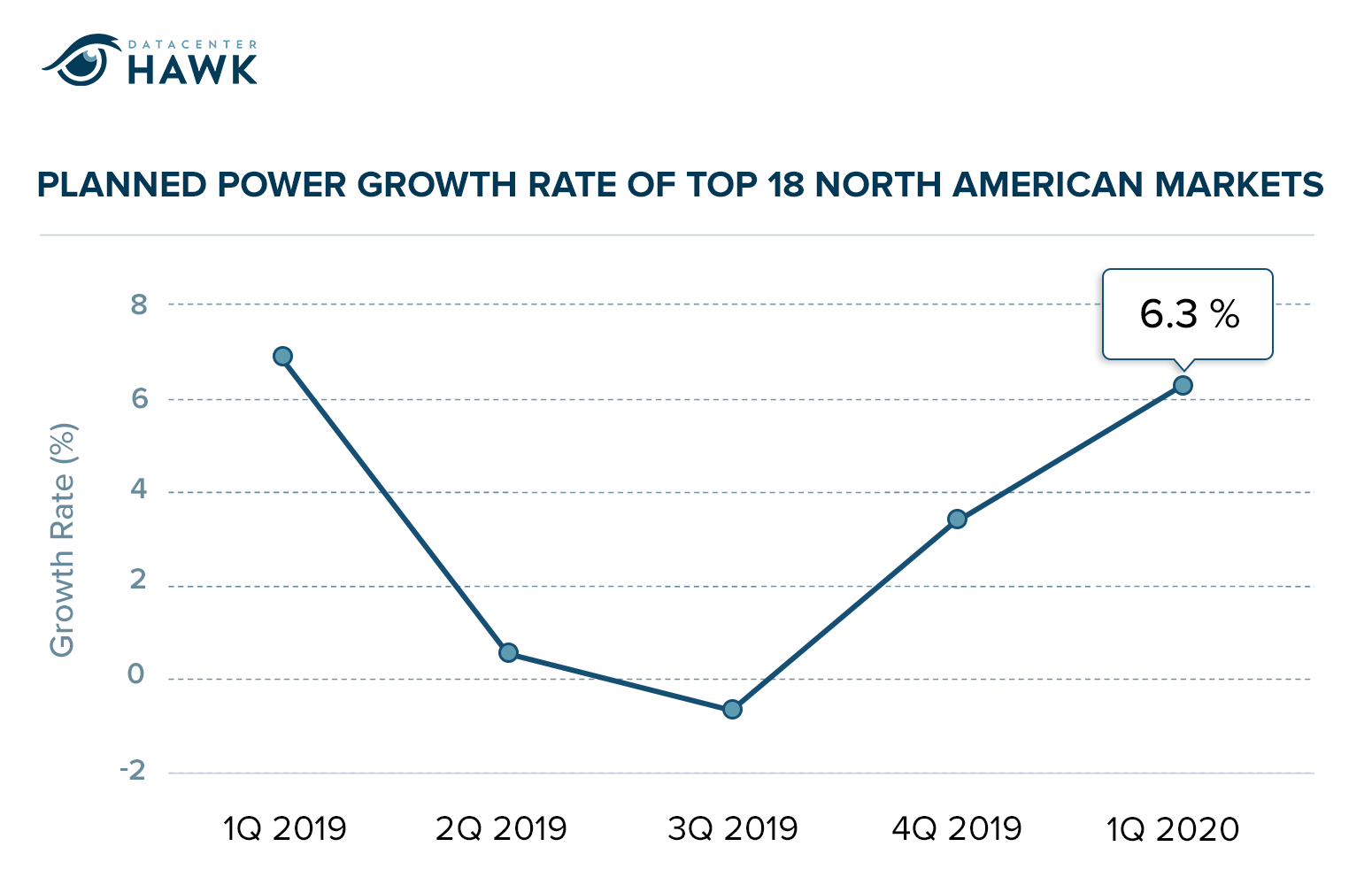

Our data also shows the “planned power” metric (measuring projects not started but planned to be delivered in the future) increased as well.

In North America, planned power is up 6.3% this quarter, which signifies the belief that future data center demand will continue to grow in major and secondary markets across the US and Canada. We saw a similar increase of 6.9% in 1Q19 as well. In Europe, planned power is up 8.4% compared to the prior quarter.

In 1Q 2020, planned power grew 6.3% in the top 18 North American data center markets.

In 1Q 2020, planned power grew 6.3% in the top 18 North American data center markets. (Atlanta, Chicago, Dallas/Fort Worth, Los Angeles, New York, Northern California, Northern New Jersey, Northern Virginia, Phoenix, Seattle, Boston, Houston, San Antonio, Minneapolis, Portland, OR, Toronto, Montreal, Quincy)

The increases in supply to the market (some of which was pre-leased) and planned power reveals how data center operators are positioning themselves to handle the anticipated future growth of enterprise and hyperscale demand.

1Q 2020 brings absorption increases in a number of US markets

Data center demand was strong across a number of markets in 1Q 2020. Increased growth from cloud service providers, the financial sector, and other enterprise users drove vacancy rates down in markets like Northern Virginia, Phoenix, Northern California, Frankfurt and several other major US & European markets.

1Q 2020 absorption in Northern Virginia was 71.5 MW  , creating one of the strongest historical leasing periods in the world’s largest data center market. Compared to the 2019 total Northern Virginia absorption of 125 MW

, creating one of the strongest historical leasing periods in the world’s largest data center market. Compared to the 2019 total Northern Virginia absorption of 125 MW  , it’s reasonable to assume 2020 will be a stronger demand year.

, it’s reasonable to assume 2020 will be a stronger demand year.

Phoenix absorption in 1Q 2020 surpassed the annual Phoenix absorption number in 2019  . Demand in Phoenix is increasing because the Valley of the Sun continues to attract cloud service providers and enterprise users with footprints wanting to grow or execute sale-leasebacks in the area.

. Demand in Phoenix is increasing because the Valley of the Sun continues to attract cloud service providers and enterprise users with footprints wanting to grow or execute sale-leasebacks in the area.

Vacancy rates in major North American markets dropped to their lowest levels since 1Q 2017, hitting 8.5%  . This comes in a full percentage point lower than the average vacancy rate over the prior four quarters, which was 9.7%. In Europe, the vacancy rate in major markets came in at 9.2%, about half a percent under their prior two quarter average of 9.70%. It’s important to note that our methodology includes pre-leased deals in our commissioned capacity calculations when measuring a market’s vacancy rate.

. This comes in a full percentage point lower than the average vacancy rate over the prior four quarters, which was 9.7%. In Europe, the vacancy rate in major markets came in at 9.2%, about half a percent under their prior two quarter average of 9.70%. It’s important to note that our methodology includes pre-leased deals in our commissioned capacity calculations when measuring a market’s vacancy rate.

COVID-19’s impact on the data center market

While the industry has been impacted both positively and negatively by COVID-19. However compared to other industries or real estate asset classes, people’s outlook on the data center industry is certainly more positive.

While some end-user requirements understandably are delayed until more details surrounding COVID-19’s impact develop, a number of opportunities have been created because of the way companies are using IT infrastructure to support their business.

The industry has also experienced users with increased bandwidth needs due working from home and an uptick in infrastructure usage.

We believe these opportunities will continue after the surge from working from home leaves and the “new normal” begins. We recently discussed how end users were impacted in detail in our latest podcast.

Data center operators have focused on protecting their team members and customers, while ensuring their operating procedures are in tune with the regulatory changes announced to continue operating their facilities at the highest levels. Several have given charitably to local food banks and ministries focused on helping people in need.

Cloud platform and internet use surges as COVID-19 forces working from home

As more countries enforce shelter in place orders, workers are having to rely more on online platforms to do their jobs. Microsoft Teams is reporting 44 million daily active users, more than double the 20 million daily active user count they reported prior to the crisis. Zoom Video Communications reported a 35% year over year increase in the first two week of March, where Work From Home orders were mandatory. COVID-19’s impact on the grocery business is significant, and companies like Amazon, Walmart and Instacart will all benefit from consumer shifts to grocery shopping online versus live in store.

In Europe, internet exchanges are seeing record level traffic. DE-CIX, the German internet exchange, broke their record in March just three months after breaking it in December. AMS-IX is up more than 15%  compared to the month leading up to their lock down.

compared to the month leading up to their lock down.

A strong 1Q indicates a strong 2020

We believe that increased cloud usage resulting from COVID-19 will drive demand in US markets where this growth typically occurs - Northern Virginia, Phoenix, Northern California, perhaps Chicago, Dallas, Atlanta and Portland as well. We believe this will continue as well in major European markets, where supply is somewhat tight and pre-leasing continues to drive large requirements. We also believe questions around supply chain reality could push cloud players to pro-actively increase take downs to ensure access to supply when needed.

While certain enterprise user demand is paused for now based on uncertainty, we anticipate the demand will increase here toward the end of the year.

With the strong 1Q 2020 growth numbers and supply in place (or quick to be in place) to handle the future growth, we believe the data center industry is positioned well to handle the opportunities and challenges that will accompany COVID-19.

This article is a free preview of Hawk Insight, a quarterly release of datacenterHawk’s market research product for data center professionals.

With Hawk Insight, you can easily access the latest supply, vacancy, absorption, pricing, and trend information for 20+ data center markets across North America and Europe. If you want more data and analysis like this article, you can subscribe to our monthly update, sign up for a free trial, or chat with us to get the data you need.