By David Liggitt · 2/2/2023

Across all major markets, over 3,200 MW of absorption occurred. Transactions are getting larger and a wider pool of companies are executing large-scale leases. These companies are also globalizing quickly, absorbing capacity, and developing new data center space in markets around the world. As a result, the majority of major and emerging markets have a shortage of power and land suitable for development.

North American Data Center Markets

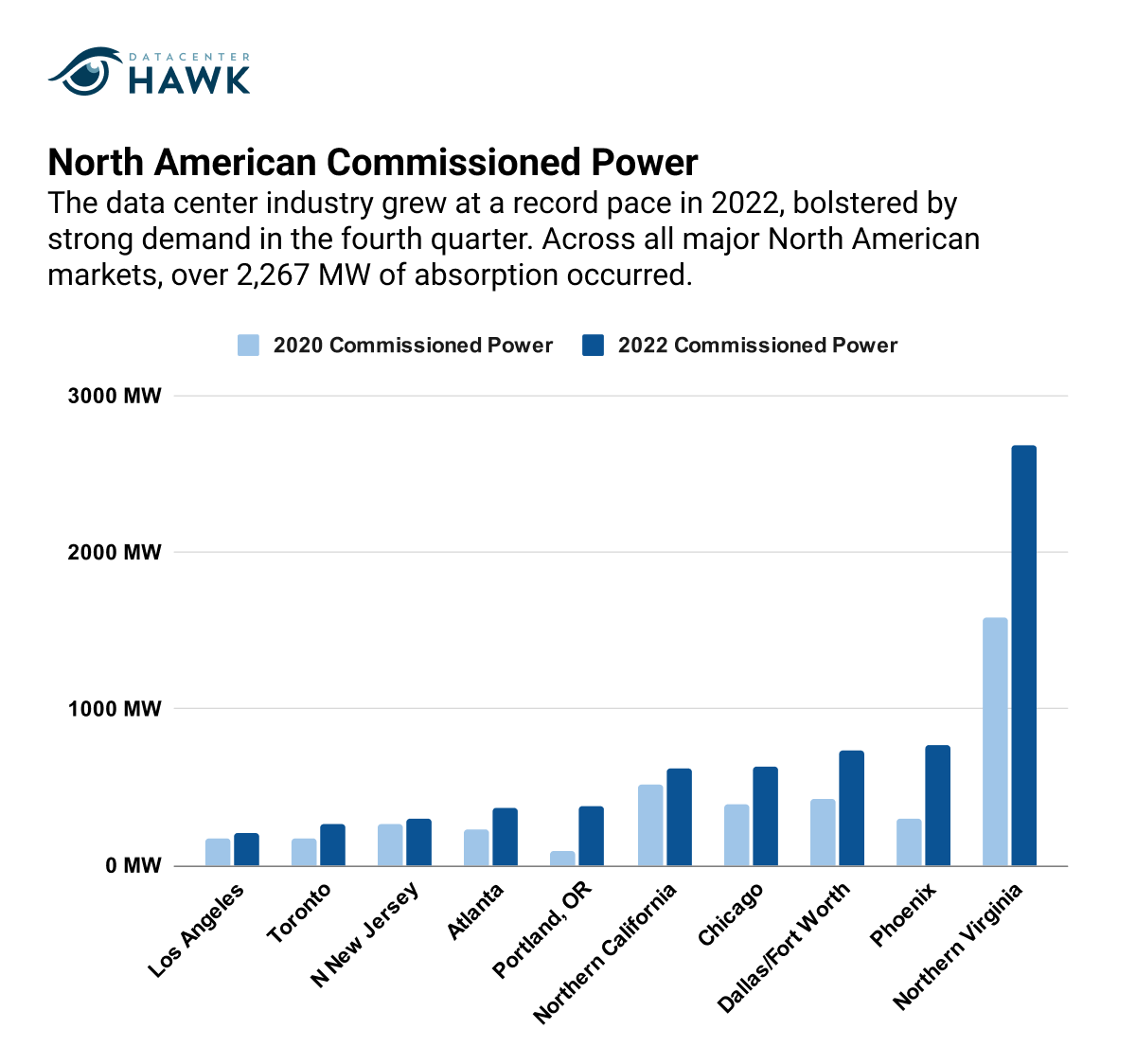

The North American data center market began and ended 2022 with the two largest periods of absorption ever seen. The 525 MW of demand in major markets in 4Q 2022 brought the region’s annual total to 2,267 MW, a 137% increase YoY. Demand was spread throughout North America, generating record absorption in many markets. For Atlanta, Dallas, Denver, Las Vegas, Phoenix, Portland, and Salt Lake City, the amount of absorption in 2022 represented over half of all the markets' historical absorption.

North American Commissioned Power

Notable Trends

Record demand and absorption across major markets

Records were broken in 2021 after approximately 950 MW of absorption occurred in the year. Over 2,250 MW of absorption occurred in 2022, however, nearly 2.5 times more than the amount taken down in 2021. Demand for data center capacity was at an all-time high in 2022. Hyperscale requirements were larger than in prior years, often encompassing 70+ MW in a single lease. These transactions also occurred more frequently, from a larger group of companies, and in a wider selection of markets. Demand from enterprise users was also robust, particularly from financial, gaming, and tech companies.

Lack of supply and uncertain market conditions

The large demand increase left the industry at its lowest vacancy rate ever, at 3.6%, with nearly 300 MW of combined available power across major North American markets. A major portion of this capacity is stranded or in non-contiguous pieces under 5 MW. Little supply is available for large-scale leasing and companies must often pre-lease infrastructure in large quantities, causing providers to develop their land inventory faster than anticipated. As a result, many markets have a limited supply of land suitable for development and power infrastructure installed to meet demand. Since planning new developments now takes longer, many markets saw a decrease in planned power in 4Q 2022.

Areas with streamlined development processes experienced the most growth

Major North American data center markets combined for over 2,000 MW of commissioned power growth in 2022, an average of 33% per market. Atlanta, Chicago, Dallas, Northern Virginia, Phoenix, and Portland grew by much larger margins. These markets are suitable for development, with favorable costs and available real estate. Markets where development is more heavily regulated and restricted saw less growth. Northern California began 2022 as the second largest data center market in North America but now ranks as the fifth largest behind Northern Virginia, Phoenix, Dallas, and Chicago.

Looking Forward

Although it’s unlikely demand will decrease, growth in 2023 will be more subdued. As stated above, many major markets have limited power supplies and emerging markets are also quickly running out of power. The pace at which development can occur is slowing down, which will impact the total growth in 2023. An emerging trend that will continue is the development of gigawatt campuses. Given the scale of demand, and complications with procuring power and receiving permitting approval, some companies have found it simpler to expand the scope of their campuses and develop sites with 10+ buildings and 1,000 MW of utility power.

European Data Center Markets

The European data center market had a successful year, with total absorption in major markets doubling the previous year. Hyperscale demand is high, leading to the rapid absorption of many of the large projects and campuses planned in major markets. Dublin’s absorption was particularly high. Demand for data center infrastructure in the Dublin market is strong, but the power supply is limited. As a result, entire campuses are pre-leased soon after power is procured. A lack of available power in Dublin and Amsterdam has also benefitted Paris, as some of the demand that would have occurred in those markets has instead opted for France.

Notable Trends & Markets

Legislation will impact development and operation

The European Union is in the process of implementing a variety of new legislations to regulate how data centers are built and the operations that occur within them. The new legislation increases data center users' and providers' responsibility to report on energy consumption and requires demonstrations of sustainability practices. Companies, particularly social media and content distributors, must also provide documentation of mitigation measures against harmful advertising and surveillance algorithms, and how it handles user data. Failure to do so could result in fines and business disruption.

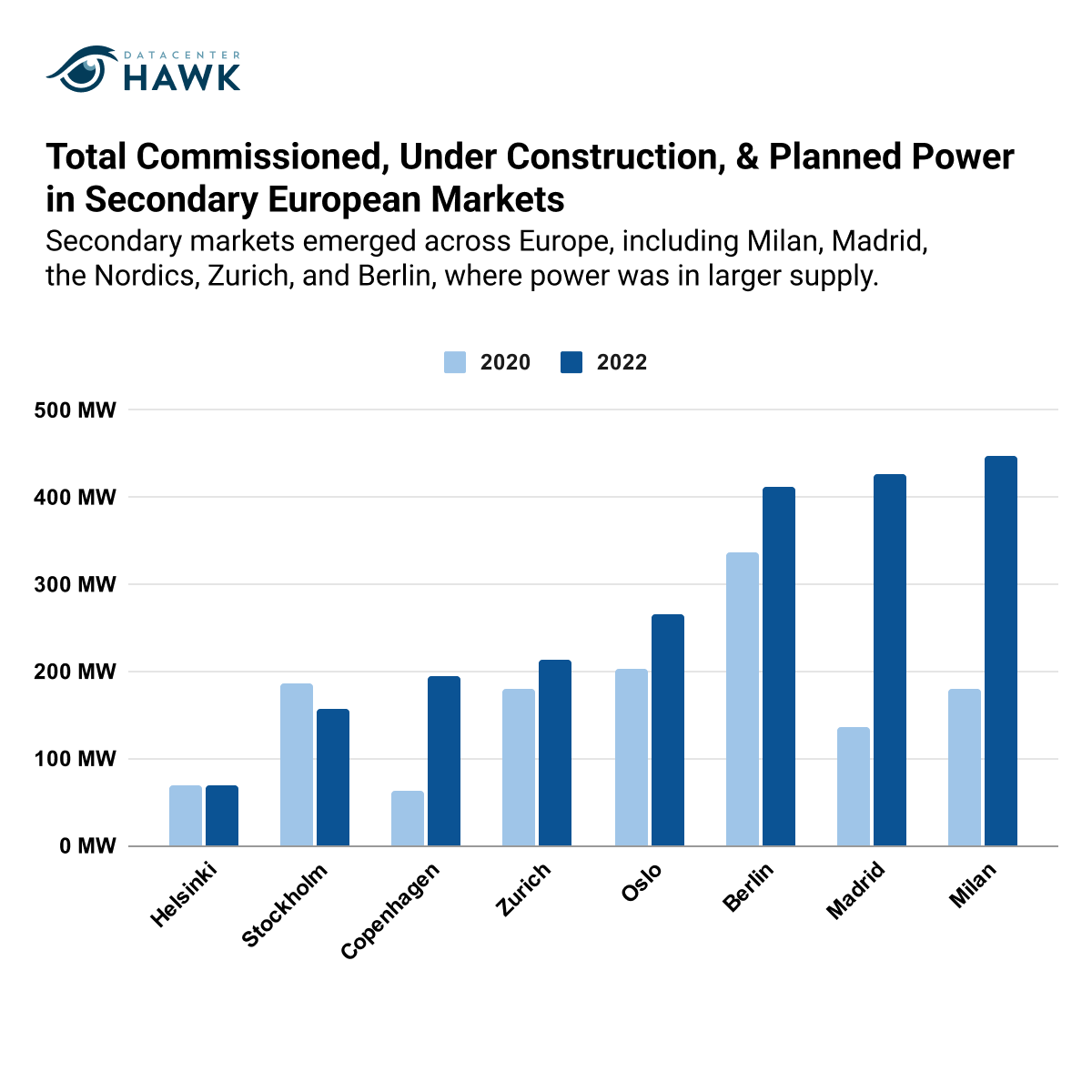

Emerging markets experience limitations similar to primary markets

Similar to major North American markets, major European markets have a limited supply of power and land suitable for development. In response to this, multiple secondary markets emerged across Europe, including Milan, Madrid, the Nordics, Zurich, and Berlin, where power was in larger supply. Many of these markets are now as limited as the primary markets due to hyperscale demand and the rapid absorption of new developments.

Total Commissioned, Under Construction, & Planned Power in Secondary European Markets

Investments and capital contributing to new providers' development

An influx of new capital is coming to the European data center industry in the form of new data center providers and investments in existing companies. In Madrid, Thor Equities and Merlin Properties are under construction with two major projects that will result in over 100 MW of new commissioned power. American provider Prime Data Centers also plans to construct a facility in Madrid, one of its first facilities in Europe, through a partnership with Macquarie Capital. Compass Data Centers is also developing its first European data center campus in Milan. Digital Reef has plans to construct two massive campuses on the Eastern and Western ends of the London metro.

Looking Forward

Data centers are under increased scrutiny in Europe, a trend that will likely spread to other regions. Some new regulations are an important step in responsibly stewarding the need for digital infrastructure, while others have the potential to complicate data center development and operations. As seen in the limited growth of the data center industry in highly regulated markets like California, stricter legislation often hinders development. This has already impacted development in the Netherlands and proposed efficiency legislation in Germany would have a similar result.

Asia-Pacific Data Center Markets

Growth in APAC is incredibly widespread, due in part to the broad demand across the entire region and the geographic nature of the region limiting the creation of one central communication hub. Development continued in major markets, such as Singapore, Hong Kong, and Tokyo, though power constraints, a lack of land, and generally higher development costs limited overall development in those markets. Absorption in these markets was higher than in 2021 due to a backlog of demand and pre-leases executed on newly planned projects.

Notable Trends & Markets

New markets emerging across APAC

APAC is one of the fastest growing regions in the data center industry. While the bulk of development historically took place in Hong Kong, Singapore, Sydney, and Tokyo, markets across the entire region are emerging as popular areas for development and investment. Malaysia’s strategic location and proximity to Singapore is contributing to elevated interest in Kuala Lumpur and Johor. Development is also on the rise in the South Pacific, with multiple projects underway in Perth, Melbourne, Canberra, and Auckland from data center providers and hyperscale companies.

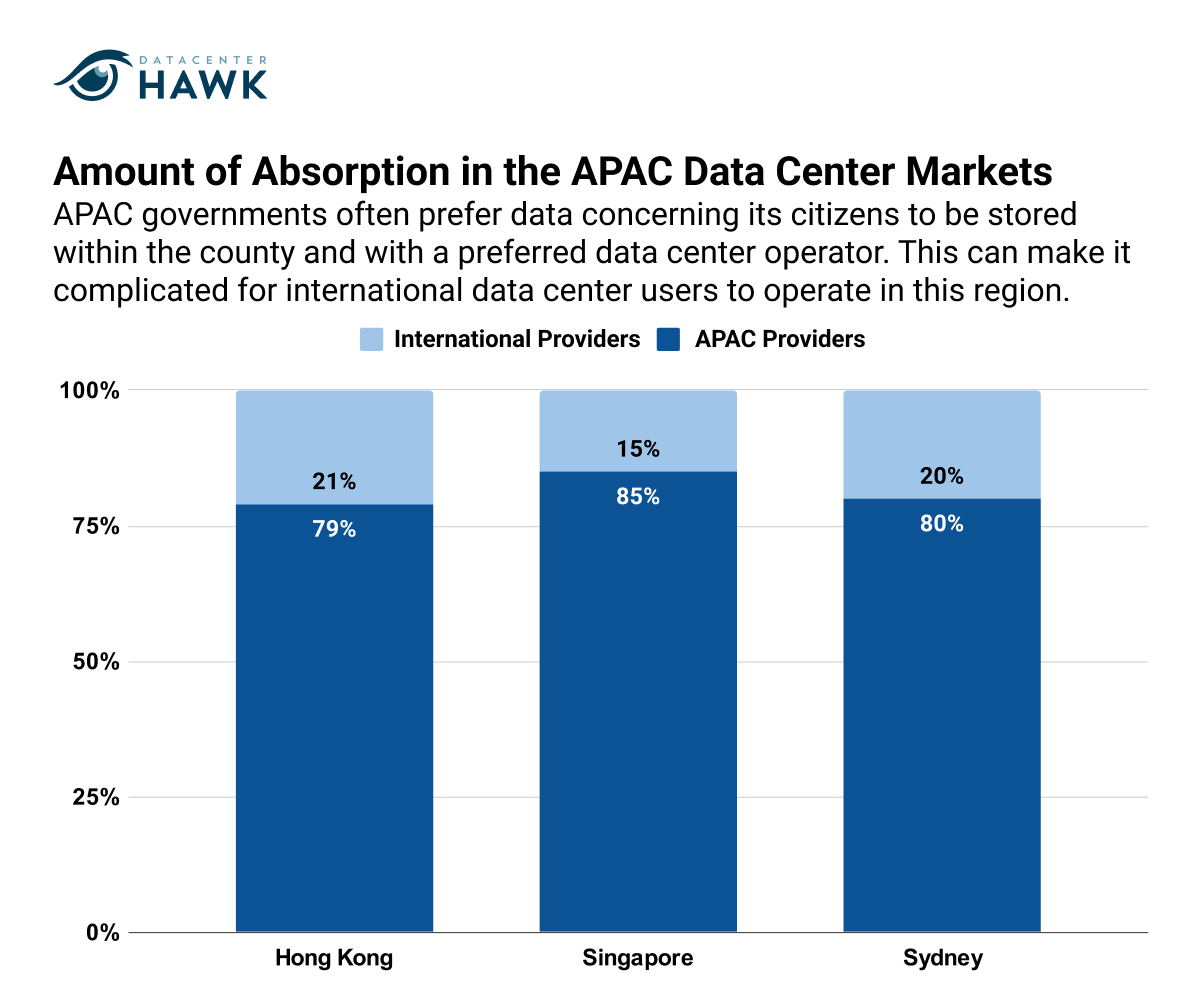

Data sovereignty laws favoring APAC data center providers

Data sovereignty is an increasingly important factor in doing business in APAC and other international markets. Governments of these countries often prefer, or even require, data concerning its citizens to be stored within the county and with a preferred data center operator. This can make it complicated for international data center users to operate within these countries and for international providers to compete with APAC providers to attract clients.

Amount of Absorption in The APAC Data Center Markets

Looking Forward

With development opportunities limited in Singapore and Hong Kong, many markets are positioned to emerge as vital communication hubs in the Pacific. The direction of data traffic flow favors markets in the South Pacific and in the seas between Indonesia, Malaysia, and mainland Asia. As a result, cities along these routes will see some of the largest strategic development.