By Luke Smith · 12/31/2015

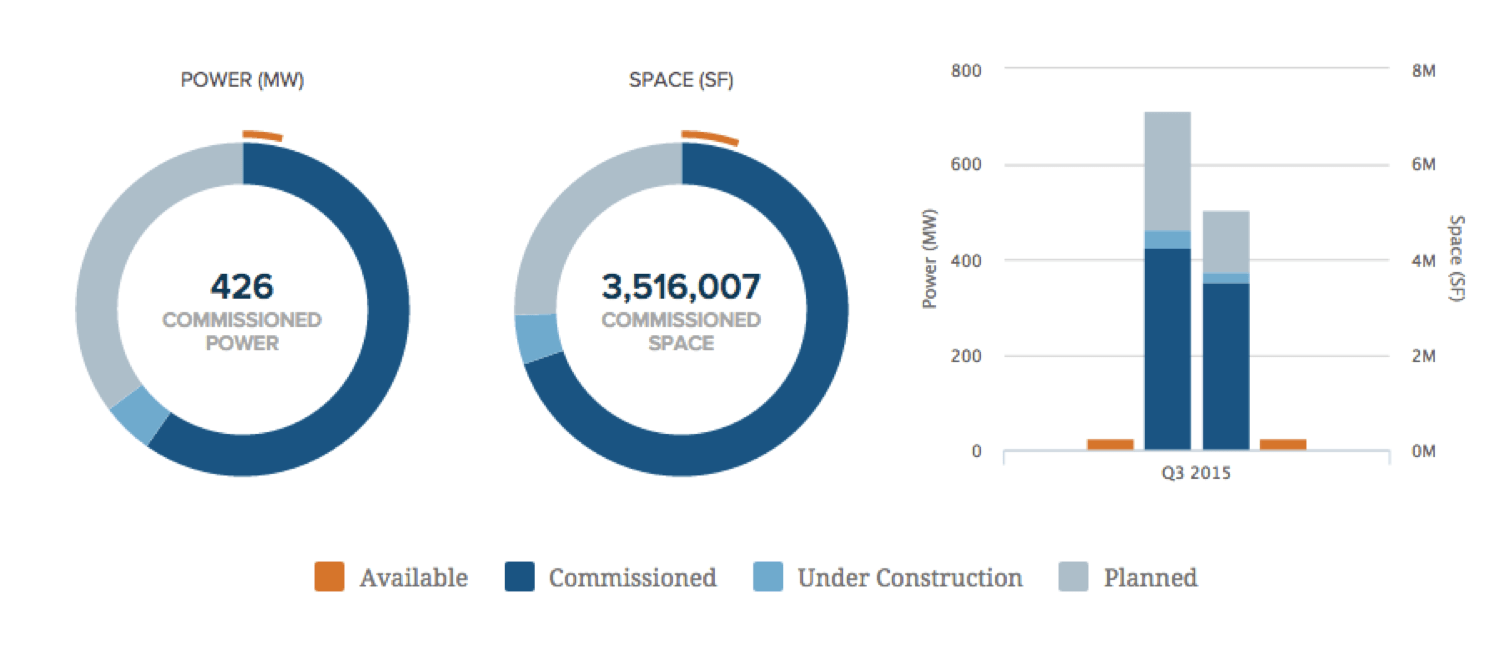

In terms of overall power capacity, Northern Virginia is the United States' largest data center market. With over 426 MW of commissioned critical power, this extremely mature market traces its roots to the U.S. Government's experiments in wide area fiber optic networking in 1969. Since then, the Northern Virginia area became a hub of low-latency connections to the national fiber network backbone serving Washington, DC's biggest public and private enterprises.

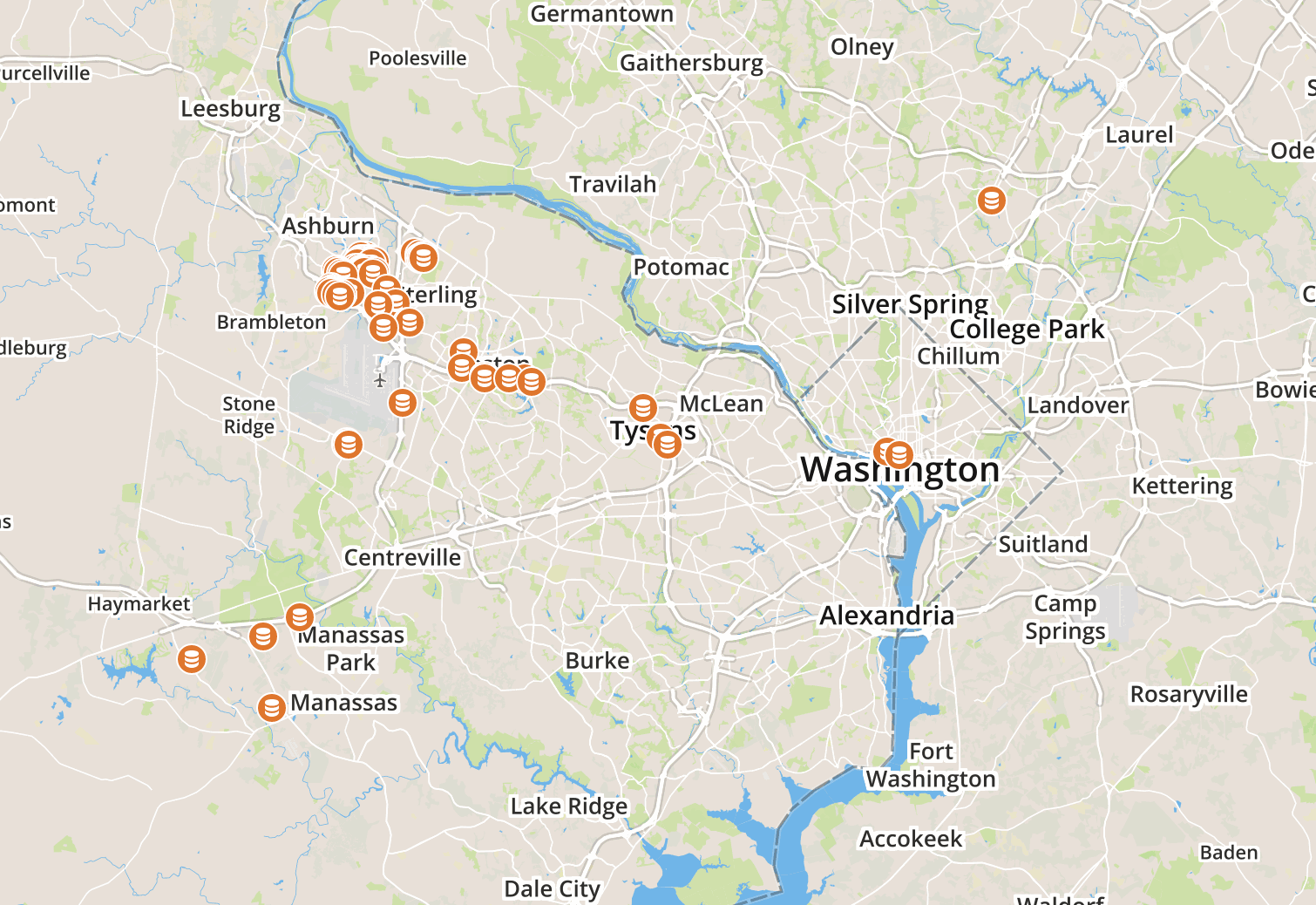

The bulk of data center investment in Northern Virginia occurs in the suburbs of Washington, DC. Most notably are the clusters of colocation, cloud, and enterprise data centers located in Ashburn, VA. The Ashburn area—a suburb north of Dulles Airport so dense it is commonly referred to as "Data Center Alley"— is dominated by massive facilities built by the industry's top data center providers. Digital Realty, DuPont Fabros, and Equinix have continually invested in the area by building large multi-tenant data centers. Ashburn, VA's relatively low property costs compared to Washington, DC are one of the main reasons data center providers are moving to the suburbs.

While government agency requirements are a contributor to data center demand in Northern Virginia, the majority of the market is made up of other industries finding the market attractive. Aerospace, financial, managed hosting, technology, and telecommunications companies have all staked claims in Northern Virginia's data centers. To meet the region's voracious demand for colocation and cloud data centers, the entire Northern Virginia market has experienced uncommonly-rapid growth for electric power generation and transmission. Compared to the rest of the Mid-Atlantic region, commercial electricity rates in the Northern Virginia market are among the lowest.

The Northern Virginia market is also viewed as relatively free of natural disasters. Disaster risks are low overall because Northern Virginia is far enough inland to avoid the full force of hurricanes and there is very limited seismic threat.

Legislation making qualified data center facilities exempt from Virginia's sales and use taxes went into effect in 2009. To qualify, data center providers must spend at least $150M and create between 25-50 new jobs in the area. Revisions in 2012 not only extended those tax benefits to 2020 but also enabled aggregation of the requirements across multiple data centers and its tenants. These tax incentives help attract data centers that would otherwise operate in the District of Columbia and Maryland.

Some of the top providers in the Northern Virginia data center market include:

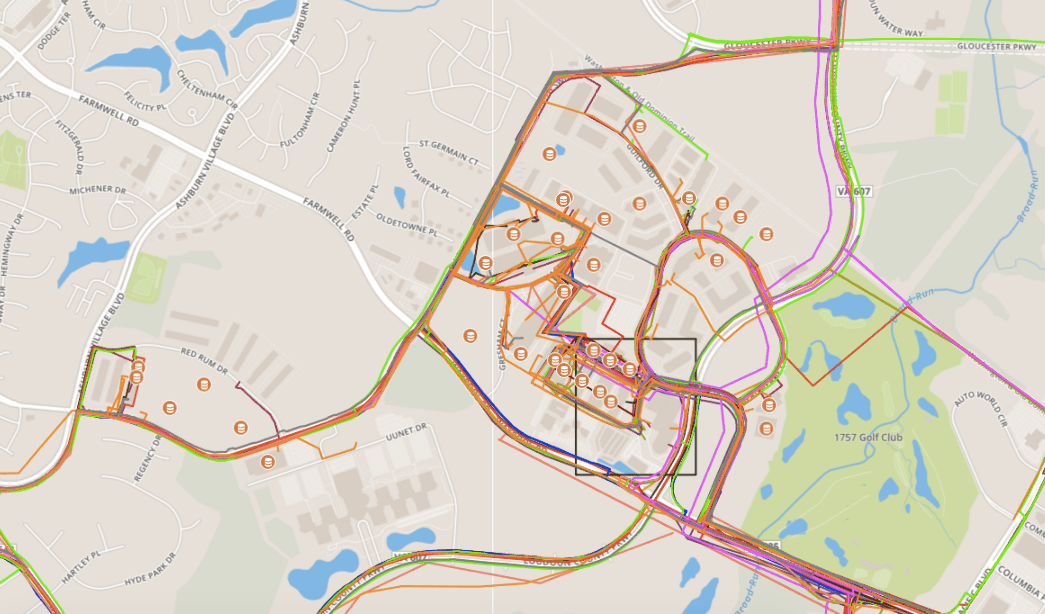

- CyrusOne – The company's 124,000 SF purpose-built facility at 21111 Ridgetop Circle in Sterling, VA came online in late 2014. A Q4 2015 expansion added additional capacity and grew the facility to 12 MW of critical load and 75,000 SF of commissioned space. At full build, the campus is capable of delivering up to 48 MW of commissioned power, 240,000 SF of commissioned data center space, and 36,000 SF of on-site office space for clients

- Digital Realty – Digital Realty has invested greatly in the Northern Virginia market, most notably at Digital Ashburn. The 98-acre site in Ashburn currently has ten buildings and is fed by two substations capable of providing up to 230 MW of power. Digital originally acquired the original three building campus in 2007, then grew by land acquisition and ground up construction in years after. The campus is close to capacity, which led Digital in Q4 2015 to acquire 125.9 acres of land for $43M. The new site is within one mile of the Digital Ashburn campus and construction will begin on the campus in 2016

- DuPont Fabros – In the Northern Virginia market, DFT operates a total of eight carrier-neutral data centers: six in Ashburn, one in Reston, and one west of Manassas in Bristow, VA. The six DFT data centers in their Ashburn Corporate Center (ACC) campus are currently capable of delivering a total of almost 165 MW critical load. As outlined in DFT's Q3 2015 earnings report, an additional 39 MWs will be available in the Northern Virginia market over the next 12-14 months. The completed 25 MW of new leasing in one month alone in 4Q. DuPont also owns two sites in close proximity to their ACC campus to grow in the future

- Equinix– Equinix is growing in Northern Virginia. The company's ten data center facilities in the market make it one of the largest investments by Equinix in their portfolio, and they are continuing to grow. Their DC11 facility was constructed in 2012 and is receiving the new market growth at this point, however, Equinix purchased additional land in mid-2015 and will begin construction in late 2016 to accommodate future growth. The new campus can hold up to five buildings

- Infomart Data Centers– The Infomart Ashburn facility, located in Sterling, VA, is a retrofit building originally built for AOL during the dot-com boom with premier fiber infrastructure. Plans call for a total of 10.8 MW of power with 5.4 MW of that currently under construction. Infomart Ashburn is currently planning six 10,000 SF data halls, with additional space for on-site offices, 24/7 security, and other services

- RagingWire– After successfully leasing their first data center in Northern Virginia, RagingWire began construction on their second. At full build, the facility will contain seven vaults with 14 MW of critical load. The first phase delivered included 4 MW and 20,000 SF of critical power and space and is currently available. RagingWire also owns 78 acres of land in Ashburn currently being held for future development

- Sabey Data Centers– Sabey is likely to soon begin construction on their 38-acre campus called Intergate Ashburn. The site is large enough to hold three buildings and is able to secure up to 70 MW of utility power, with an onsite substation to be constructed. Sabey is flexible with deal structure and can provide powered shell, wholesale/turn key, and build to suit solutions for interested data center users

Colocation requirements in the Northern Virginia market are typically larger than most markets. This is due to the nature of the requirements as well as the availability and competitive pricing in the market. The Northern Virginia market has over 100 colocation and cloud provider profiles listed in datacenterHawk's Hawk Search. This tool enables for data center users, brokers, and consultants to search markets by power capacity.

Sign up at https://www.datacenterhawk.com/register to start your own search for free.