By David Liggitt · 10/21/2020

This article is a free preview of Hawk Insight, a quarterly release of datacenterHawk’s market research product for data center professionals. With Hawk Insight, you can learn where companies are building, buying, and investing in data centers across North America and Europe.

Request access to the full release today to make better data center decisions tomorrow.

North American Data Center Markets

Data center markets in North America grew at a healthy pace. While Northern Virginia’s demand once again topped the list, other major markets captured higher absorption when compared to their demand metrics from 2Q 2020. Looking forward, an increase in speculative construction points to the industry feeling good heading into 2021.

Let’s break down the highlights from our 3Q release of data and analysis on North America.

You can also request access or log in to view the full release on our Hawk Insight platform.

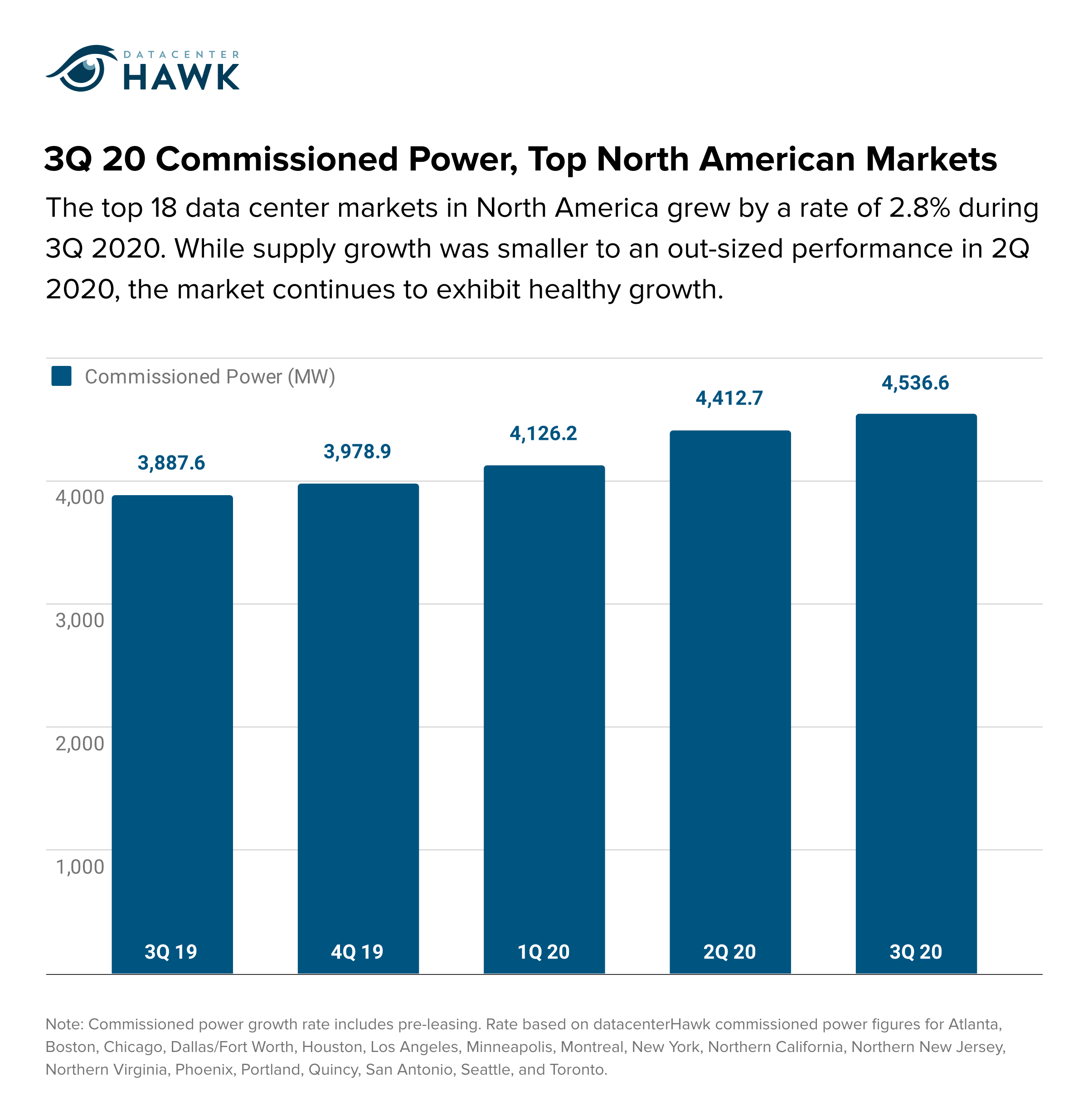

North American Data Center Market Commissioned Power Grows by 2.8%

In 3Q 2020, North American commissioned power across the top 18 markets increased by 2.8%. Typical market supply growth is approximately 3%, so 3Q supply growth fell in line with the average.

The market supply growth trend also reveals the increased levels of capital continuing to invest in the data center industry, a real estate asset class standing out in the midst of the COVID-19 pandemic.

Sizable capital investments continue to enter the space and we expect this trend to continue for the foreseeable future.

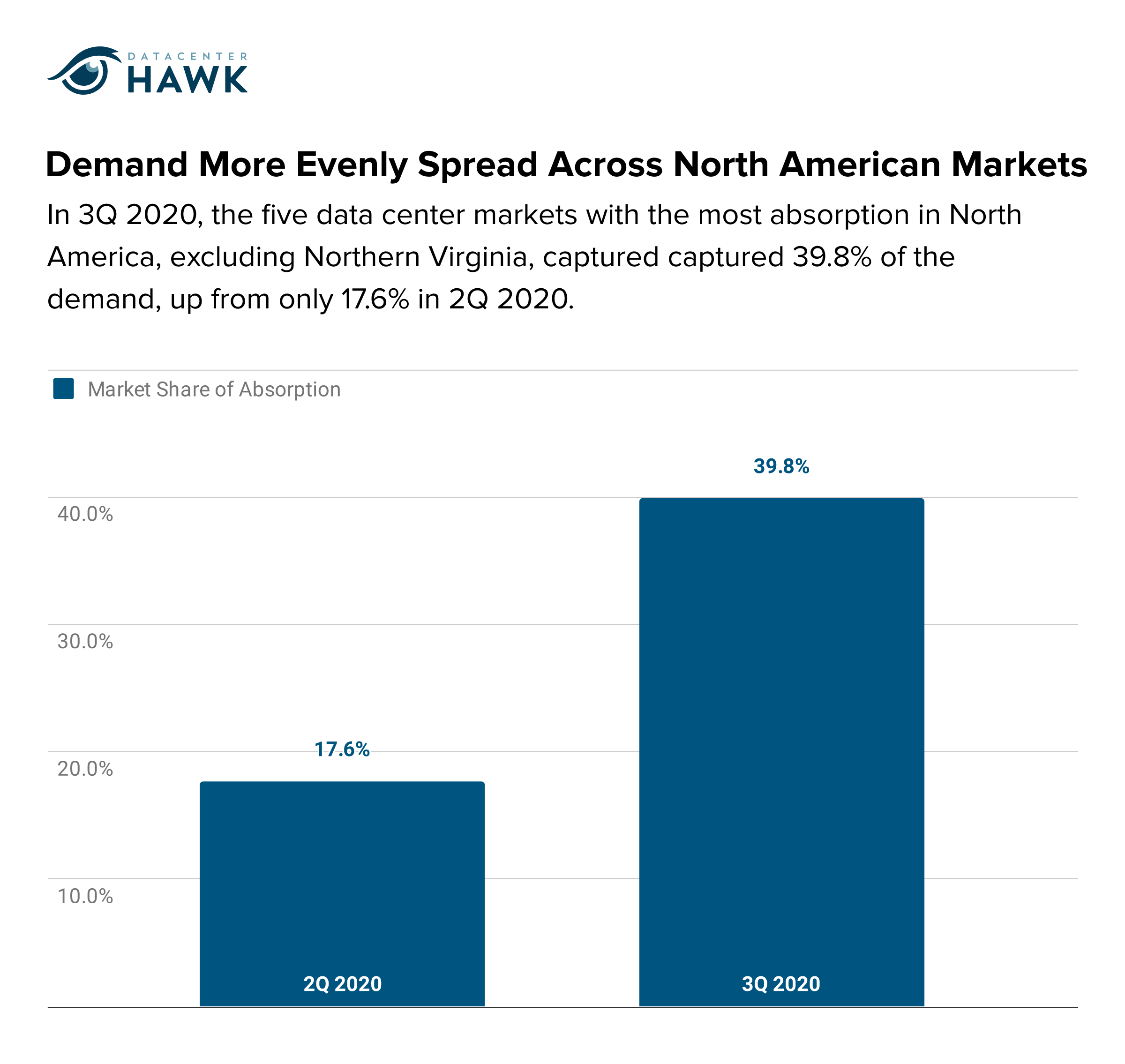

Demand spreads across major North American data center markets

During 3Q 2020, demand was more evenly spread across major North American data center markets.

In 2Q, Northern Virginia captured the majority of absorption across major North American markets. The next four strongest markets collectively captured 17% of the absorption.

In 3Q, Northern Virginia still led North American markets in their share of the absorption. However the next four markets collectively captured 39% of the absorption, more than double what they took in 2Q.

Demand more evenly spread across North American markets

The increased demand in markets point to continued interest by both hyperscale and enterprise users in maturing their footprints in these major markets.

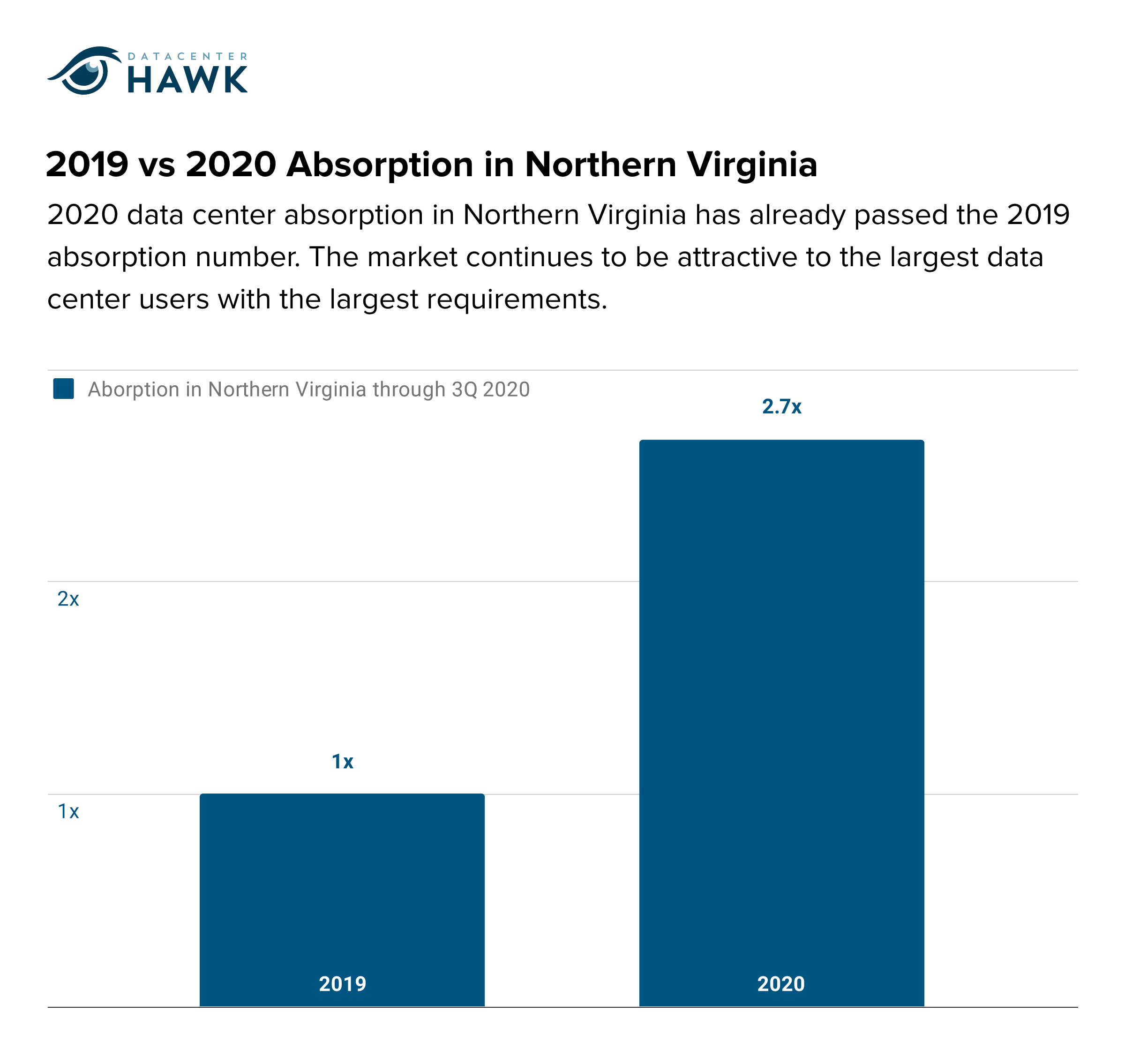

Demand in Northern Virginia still strong

The resiliency of the data center industry is on display in Northern Virginia, where market dynamics remain healthy and active.

Because Northern Virginia features the largest users with the largest requirements, the 2020 Northern Virginia market is outperforming what was already considered a strong year in 2019.

2019 vs 2020 Absorption in Northern Virginia

Users find Ashburn and surrounding areas like Sterling, Manassas, Leesburg, Reston and Chantilly attractive because of the robust power infrastructure, competitive providers, long-term growth opportunities, and network/connectivity maturity.

European Data Center Markets

In 3Q 2020, Europe continued the healthy growth among its data center markets.

Frankfurt demand continued to be strong, and providers are also planning additional investments to bring new capacity to the markets, particularly in London.

Let’s dive into the highlights from our 3Q release of data and analysis on Europe.

You can also request access or log in to view the full release on our Hawk Insight platform.

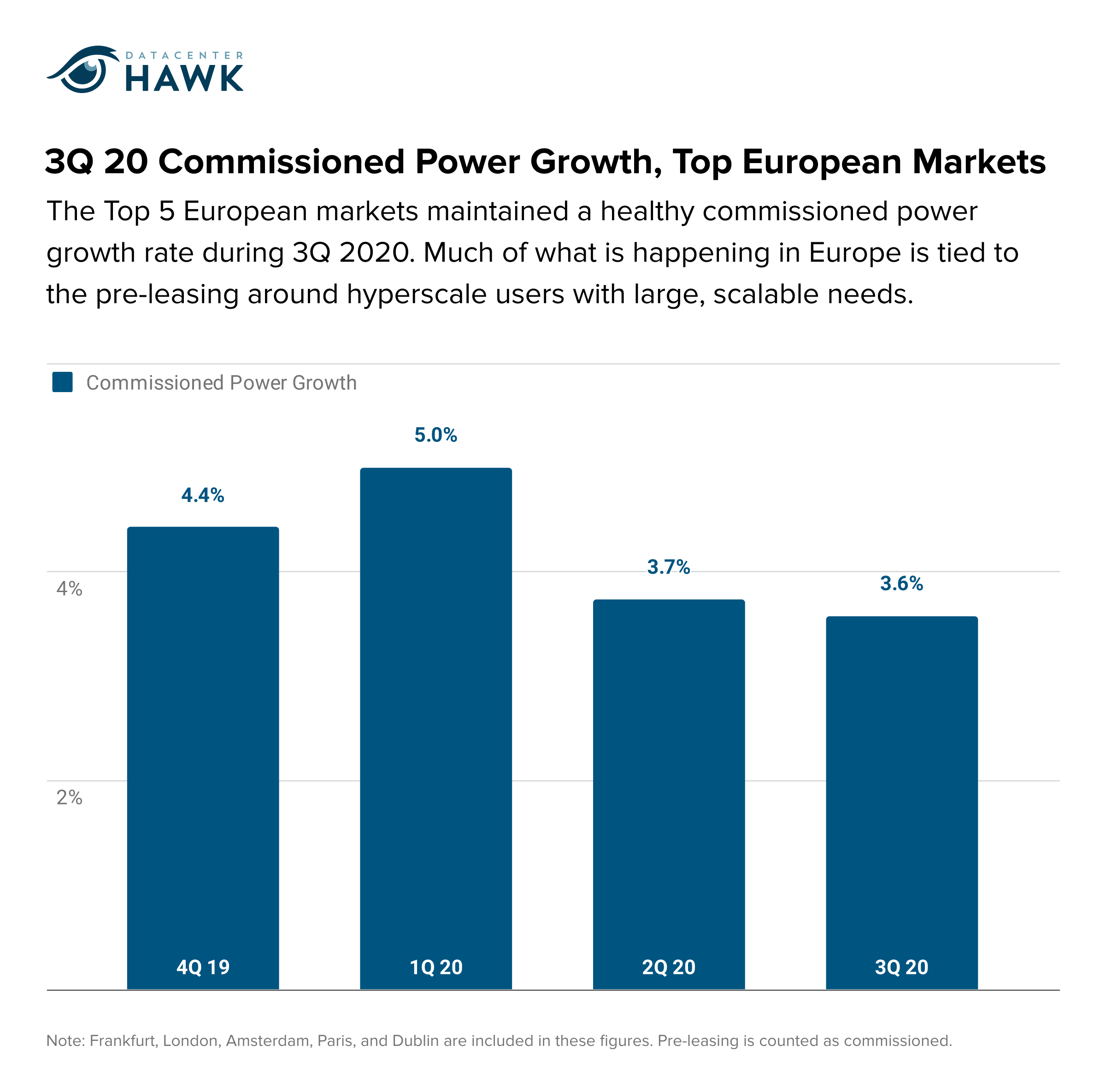

Europe Major Data Center Markets Grow by 3.6%

In 3Q 2020, European commissioned power across the top 5 markets increased by 3.6%.

Much of what is happening in Europe is tied to the pre-leasing around hyperscale users with large, scalable needs seeking maturity in the top 5 and secondary EU markets.

3Q 2020 Commissioned Power Growth Across Top 5 European Markets

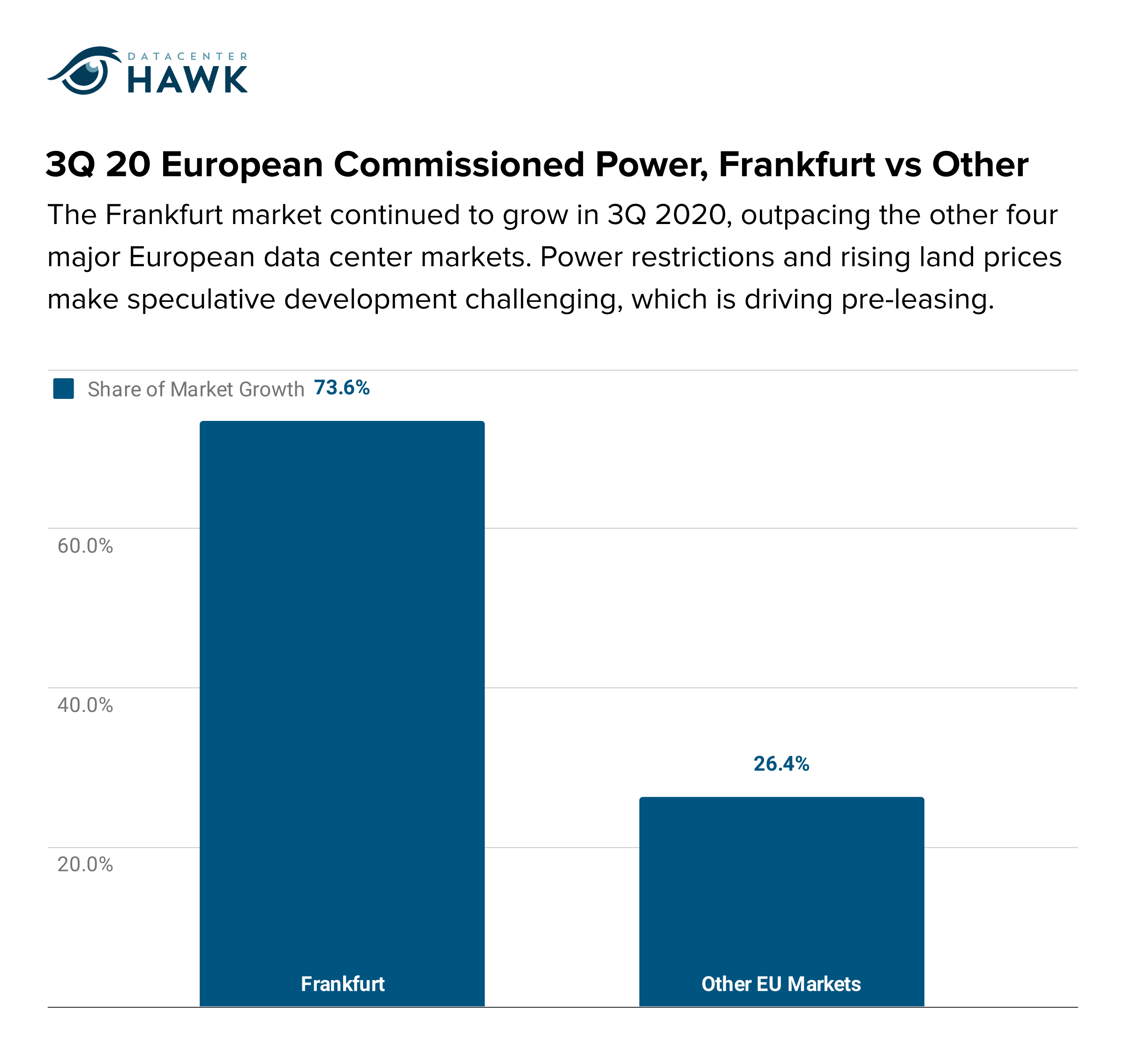

Frankfurt still drawing significant interest and investment

After a strong performance in 2Q 2020, Frankfurt’s commissioned power growth increased even more in 3Q 2020, as several pre-leases were completed.

Power restrictions and rising land prices make speculative development challenging, which is driving pre-leasing. Pre-leasing continues to be a trend in markets with development constraints.

3Q 2020 European Commissioned Power Growth, Frankfurt vs Other Markets

Providers add long-term supply to European markets

If market growth is the story of now, under construction is the story of tomorrow, and planned power is the story of next year.

After barely any new developments being announced in 2Q, providers announced plans for new facilities and expansions over 250 MW, with London being one of the landing spots for these developments.

The new announcements point to data center providers and users continuing to place a value on colocation in Europe heading into 2021.

Market Trends

Hyperscale sizes changing structure of deals

While turn key data center lease structures still work, several hyperscale users are interested in alternative ways to complete development deals. Alternative solutions include build to suit, powered shell, or modified powered shell approaches that allow the user additional flexibility with capital and timing of infrastructure delivery.

Pre-leasing prevalent in markets with limited capacity or markets attracting hyperscale demand

Limited capacity and/or markets with challenging development timelines are driving increases in pre-leasing. Pre-leasing allows large users the opportunity to reserve capacity ahead of construction beginning or completion.

What we’ll be watching for in 4Q 2020

4Q 2020 will wrap up one of the most challenging, yet successful, time periods in the data center industry. While the data center industry’s growth in 2020 is at near record levels, big demand during upcoming time periods can fluctuate. We anticipate a steady 4Q 2020 as the year comes to a close. We’re also continuing to pay attention to the enterprise sector and COVID-19’s impact on that part of the market.

This article is a free preview of Hawk Insight, a quarterly release of datacenterHawk’s market research product for data center professionals. With Hawk Insight, you can learn where companies are building, buying, and investing in data centers across North America and Europe.

Request access to the full release today to make better data center decisions tomorrow.